Podiatry practices face unique billing complexities that directly affect revenue and operational efficiency. From diabetic foot care to orthotic management, each procedure demands precise CPT and HCPCS podiatry medical coding.

While talking about podiatry billing and coding, inaccurate documentation, modifier misuse, and missed preauthorization are just a few reasons claims get denied. This is why many providers are turning to specialized podiatry medical billing services to streamline payments and reduce costly errors.

With experts handling your podiatry coding and billing, your team can focus on delivering exceptional foot and ankle care. Read on to learn everything you need to know about podiatry billing workflows and CPT code examples to improve cash flow.

Table of Contents

ToggleUnderstanding Podiatry Billing and Coding: What Makes Them Different?

Podiatric billing uses specialized codes and rules that general medical billing does not. Unlike a primary-care visit, podiatrists treat conditions ranging from routine foot care to complex surgeries. Some services, such as custom orthotics and plantar fasciitis surgery, require pre-authorization, making the podiatry medical billing process more complex.

There are also coding complexities involved, requiring help from experts compared to normal procedures in other specialties. For example,

- CPT 11720–11721 covers nail debridement

- 1055–11057 cover callus removal

- L-codes (like L3020) cover custom orthotics

- Medicare also requires “Q” modifiers (Q7–Q9) for routine foot care

Simply put, podiatry-specific billing often demands additional documentation and modifiers that general billing does not. In addition, routine foot care (like nail trimming or callus paring) is usually non-covered unless linked to a systemic condition, such as diabetes.

These differences mean podiatry billing and coding are more error-prone. So, providers must track frequent coding updates and navigate varied insurer policies.

Why Podiatry Billing Expertise Matters

- Older Patient Demographics: Many podiatry patients are Medicare beneficiaries, increasing the need for precise billing practices.

- Frequent Denials: Missing a required diagnosis code (like a diabetes or vascular disease code) or misapplying a modifier can trigger a denial.

To reduce denials and ensure compliance, many practices rely on expert podiatry billing services. In this regard, Transcure keeps up with changing codes and policies to provide expert podiatry services.

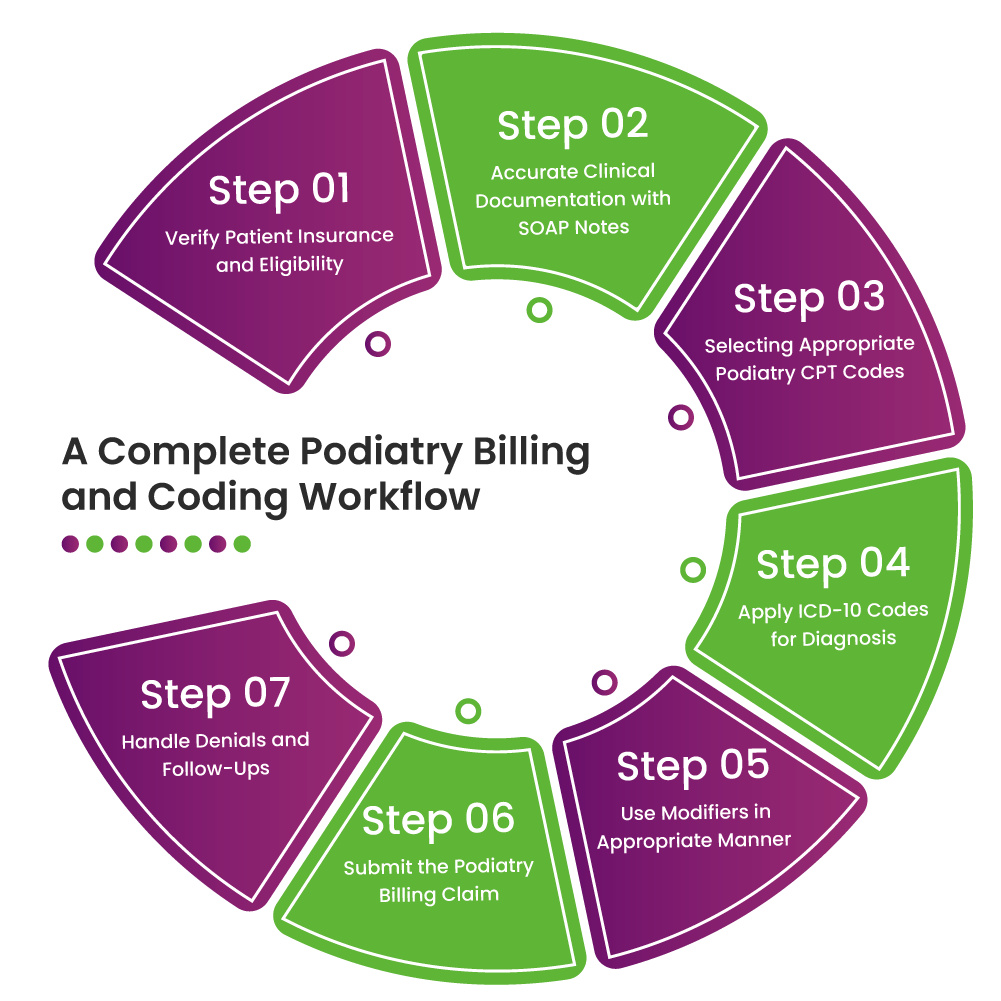

A Comprehensive Podiatry Billing and Coding Workflow

Podiatry billing isn’t just about submitting claims, as you need to follow a consistent workflow to avoid delays. Below, we break down the seven critical steps in the podiatry medical billing process to help your practice maximize reimbursements.

Step 1. Verify Patient Insurance and Eligibility

Always check the patient’s insurance status before the visit. Confirm active coverage, plan benefits, and any prior authorization requirements for proposed procedures. For example, custom orthotics and certain surgeries often need approval. So, podiatry billing teams have to verify this in advance.

Expert Tip: Always instruct patients to bring their insurance card and use an automated eligibility system to catch coverage issues early. Also, document co-pays and deductibles owed up front to avoid collections later.

Step 2. Accurate Clinical Documentation with SOAP Notes

Each visit should have a complete SOAP note, following the structure:

- Subjective (patient concerns)

- Objective (exam findings, vital signs)

- Assessment (diagnoses)

- Plan (medication or surgery)

We recommend documenting all relevant comorbidities (diabetes, peripheral artery disease, neuropathy) and findings (such as a plantar ulcer on the left heel with probing to bone). These details justify medical necessity.

Research shows linking every foot care procedure to a qualifying diagnosis (like diabetes code E11.621) can slash denials. Remember “no diagnosis, no dollars.” So, an insurer will deny a nail debridement (11721) claim if no systemic disease is coded.

Step 3. Selecting Appropriate Podiatry CPT Codes

Assign the correct CPT codes for each service. Here, we will give examples of a few of them. For a detailed podiatry code cheat sheet, go to the next section.

| Category | CPT Codes and Descriptions | Purpose in Podiatry Billing |

|---|---|---|

| Office Visits |

99202–99205: E/M services for new patients 99212–99215: E/M services for established patients |

Used for diagnosing and managing foot and ankle complaints |

| Routine Care |

11720: Nail debridement (≤5 nails) 11721: Nail debridement (≥6 nails) 11055–11057: Corn/callus paring |

Addresses routine foot care for conditions like thickened nails, calluses, or corns |

| Injections |

20550: Corticosteroid injection for small joint 20610: Corticosteroid injection for large joint peripheral 64450: Nerve blocks |

Used for inflammation, pain relief, and nerve-related conditions like neuromas or plantar fasciitis |

| Surgical Procedures |

28110: Bunionectomy 28285: Hammertoe correction 28005: Neuroma excision 28300: Achilles tendon repair |

Corrective or reconstructive foot surgeries for structural deformities and chronic pain conditions |

| Wound Care |

11042–11047: Wound debridement 97597–97598: Selective debridement for ulcers |

Supports diabetic foot ulcer management and treatment of non-healing wounds through tissue removal |

Expert Tips:

- Check NCCI edits to avoid mutually exclusive code pairings. For example, you cannot bill CPT 11056 (paring thick lesions) with 11305 (shaving lesions) as they are mutually exclusive.

- Also, never attach an E/M code with a procedure code without modifier -25. If you do bill both on the same day, use modifier -25 on the visit to indicate a separate evaluation.

- Weigh which service is primary (with higher RVU) to avoid accidentally triggering a bundling edit. When in doubt, consult the Medicare NCCI policy.

Step 4. Apply ICD-10 Codes for Diagnosis

Code the exact diagnosis to support each procedure. While doing podiatry coding and billing, you have to keep the following things in mind.

- Laterality and specificity matter, so code M79.671 for left foot pain and M79.672 for right.

- Use the most specific code, such as diabetic foot ulcer is E11.621 (if it’s the left foot) or E11.622 for the right.

- If treating diabetic neuropathy, add codes like E11.40x.

Always double-check that every routine foot care code has an accompanying qualifying diagnosis (such as neuropathy or infection) to avoid automatic denials.

Step 5. Use Modifiers in an Appropriate Manner

Modifiers provide an added context to podiatry coding to ensure procedures are correctly interpreted. The table below of podiatry billing modifiers will help you avoid costly rejections:

| Modifier | Description | Example in Podiatry Billing |

|---|---|---|

| -25 | Significant, separately identifiable E/M service | 99213-25 for visit and toenail removal |

| -59 | Distinct procedural service | 11055 + 11740-59 for callus and wart on separate feet |

| -LT / -RT | Left side / Right side | LT for left foot debridement |

| Q7, Q8, Q9 | Medicare routine foot care class findings | Q9 for neurologic findings with nail debridement |

| -TA to T9 | Toe-specific identifiers | 28285-TA for left great toe hammertoe correction |

Step 6. Submit the Podiatry Billing Claim

Once coding is complete, format the claim for submission. Most practices send claims through a clearinghouse or directly via a payer portal. Use the clearinghouse’s claim scrubbers to catch basic errors (NPI mismatches, invalid codes, missing mod).

Before finalizing, perform an internal review to check demographics and all codes. A pre-submission audit can catch up to 80% of common errors. After submission, monitor the clearinghouse report for immediate rejections (like format errors) and fix them right away.

In some cases, outsourcing this step to a specialized podiatry billing service provider like Transcure can facilitate faster time-to-pay.

Step 7. Handle Denials and Follow-Ups

Denied claims are inevitable, so podiatry billing experts need to be proactive for timely follow-up. Start by logging each denial and its reason. Common causes include missing info, bundling edits, or a lack of prior authorization. When a claim is denied, take action within a day and adjust coding before resubmitting.

Create a denial management plan as recommended by experts. For example, if multiple denials cite “no authorization,” improve your pre-auth process. In summary, work on denials daily and continuously refine processes to turn as many denied claims into paid claims as possible.

Most Common CPT Codes in Podiatry: Cheat Sheet

-

Nail Care Procedures

11719 – Trimming of nondystrophic nails

11720 – Debridement of nail(s), 1 to 5

11721 – Debridement of nails, 6 or more

11730 – Avulsion of nail plate, partial or complete

11750 – Excision of nail and nail matrix

11765 – Wedge excision of nail fold (e.g., ingrown nail) -

Skin Procedures (Corns, Calluses, Lesions)

11055 – Paring of benign hyperkeratotic lesion

11056 – Two to four lesions

11057 – More than four lesions

11307 – Shaving of epidermal or dermal lesion (trunk, arms, legs) -

Injections

20550 – Injection into tendon sheath or ligament

20551 – Injection for tendonitis at tendon origin/insertion

20600 – Arthrocentesis; small joint or bursa

20605 – Arthrocentesis; intermediate joint or bursa

64450 – Digital or plantar nerve block -

Surgical Procedures

28001 – I&D of bursa, foot

28005 – I&D of plantar fascia

28100 – Partial excision, tarsal/metatarsal bone

28108 – Partial excision, toe phalanx

28285 – Hammertoe correction

28296 – Hallux valgus correction with sesamoidectomy

28300 – Osteotomy with/without fixation

28308 – Osteotomy of base or shaft

28400 – Closed tx of metatarsal fx, no manipulation

28405 – Closed tx of metatarsal fx, with manipulation -

Wound Care

11042 – Debridement of skin/subcutaneous tissue

11043 – Debridement to muscle/fascia

11044 – Debridement to bone

97597 – Debridement of open wound, first 20 sq cm

97598 – Each additional 20 sq cm -

Orthotics and Prosthetics (HCPCS Level II)

L3000 – UCB-type foot insert, custom-molded

L3020 – Custom foot insert, arch support

L3040 – Prefabricated arch support

L3050 – Custom-fabricated arch support

Value Tip: Always verify NCCI edits before coding combinations. Use LT/RT modifiers when billing bilateral surgical procedures.

Top Challenges in Podiatry Billing and Coding Teams Face

Podiatry medical billing staff must conquer a variety of hurdles. Here are six common challenges (and why they matter) in podiatry RCM:

Complex Coding Requirements

Podiatry spans many specialized codes for foot and ankle care. A single miscoded service can lead to a claim denial or downcode. For example, confusing CPT 11056 with 11305 (mutually exclusive codes) can void an entire claim.

Insurance Coverage Variability

Payers often treat podiatry differently. Medicare, Medicaid, and commercial plans have inconsistent rules, as some impose strict frequency limits. In such cases, verifying eligibility and obtaining pre-authorizations is critical. If insurance isn’t checked beforehand, claims will be denied for lack of prior auth or non-coverage.

Documentation and Compliance Gaps

Incomplete records or missing justification for a service (such as not listing diabetes when trimming nails) lead to denials. Podiatry billing services providers must include detailed exam findings and systemic conditions to meet medical necessity criteria.

Patient Collections and Communication

Many practices struggle to collect patient balances (co-pays, deductibles). Patients often don’t understand what is covered under “medical” vs “routine” foot care. This leads to billing disputes and slow payments. Practices need to clearly explain costs up front and offer payment plans.

Conclusion

To summarize, accurate medical billing for podiatry is essential to keep your practice financially healthy. Precision at each step, from eligibility verification to coding, modifier use, helps capture all entitled revenue. With so many podiatry billing and coding nuances, a single mistake can trigger a denial or audit.

For busy podiatry practices, partnering with experts can make a big difference. Transcure’s podiatry billing services specialize in precisely this work. Their team stays current on podiatry coding changes and payer policies to assist in improving collections. If you want to maximize reimbursement, consider Transcure’s podiatry medical billing services.

Frequently Asked Questions (FAQs)

What Are Some Common ICD Codes for Podiatry Medical Billing?

In podiatry billing, the following ICD-10 codes are commonly used:

- E11.621: Type 2 diabetes mellitus with foot ulcer

- L84: Corns and callosities

- M79.671: Pain in the left foot

- M77.31: Plantar fasciitis, right foot

- L60.0: Ingrowing nail (onychocryptosis)

How Much Do Podiatry Billing Companies Usually Charge?

Podiatry billing service fees vary based on the complexity and volume of claims. Most companies typically charge between 5% and 10% of monthly collections. However, Transcure offers a more affordable pricing model, charging only 3 to 6 percent of collections.

What Is Modifier 59 in Podiatry Billing and Coding?

Modifier -59 is used in podiatry to indicate that two or more procedures performed on the same day were distinct and separate, even if they might normally be bundled together.

Example in Podiatry: If you perform callus removal (CPT 11055) and wart removal (CPT 17110) on different parts of the foot, you would use modifier -59 to indicate that these are separate services.