Dental practices in the United States submit millions of insurance claims each year, yet an average of 15% of dental claims are denied, leading to significant revenue leakage. With so much at stake, efficient dental billing and complete revenue cycle management have become essential for financial health.

Against this backdrop, many practices are turning to specialized dental partners. In this guide, we’ll explore how dental billing differs from conventional medical billing and walk through a complete billing workflow.

We will also share practical tips and provide extensive code cheat sheets to help your practice minimize write‑offs. Read this article till the end to find the best dental billing company to optimize RCM and maximize collections.

Table of Contents

Toggle- How Does Dental Billing Differ from Conventional Medical Billing?

- A Complete Guide on How to Perform the Dental Billing Process

- What are the Common CDT Code Categories?

- An Extensive Code Cheat Sheet for Dental Billing

- CDT Codes (Most Common Procedures)

- ICD-10 Codes (Common Dental Diagnosis)

- HCPCS Codes (Level II Dental-related)

- CPT Codes (Medical Procedure Codes)

- What are Some Practical Tips to Follow for Dental Billing?

- Conclusion

- Frequently Asked Questions (FAQs)

How Does Dental Billing Differ from Conventional Medical Billing?

Practices now rely on specialized dental billing services that differ in key ways from common medical billing. Understanding the following differences helps you do accurate claim processing and optimize revenue cycle management.

- Coding Systems: Dental billing uses CDT codes for procedures, while medical billing uses CPT codes. CDT codes are maintained by the ADA, whereas CPT codes are managed by the AMA and WHO, respectively.

- Procedure Focus: On one hand, dental billing covers routine oral care, such as cleanings, fillings, restorations, billed to dental plans. Alternatively, medical billing services cover broader healthcare services. However, many complex dental treatments overlap, as implants, biopsies, or TMJ treatments have medical implications.

- Code Updates: Dental and medical codes update on different schedules. The ADA issues CDT codes annually, requiring practices to stay current with each year’s CDT edition. Medical codes also update yearly, but their changes are regulated by the AMA.

- Predetermination and Documentation: With dental insurers, you will need predeterminations to clarify coverage for planned treatment. Typically, medical insurers require pre-authorization for complex procedures, but not for regular ones. Thorough documentation is vital in both fields, but dental claims specifically require attachments like X-rays and charts.

- Regulatory Oversight: Medical billing is governed by extensive federal regulations because of Medicare/Medicaid involvement. On the other hand, dental billing is mostly regulated by ADA guidelines and state insurance laws.

How Medical Billing Can Complement Dental Billing?

In many cases, using medical billing alongside dental billing can boost practice revenue. For example, certain dental procedures have medical necessity or overlap with general health. As noted by billing experts, CPT codes do apply to dentistry, particularly when it comes to specialty treatment such as oral surgery.

For example, an oral surgeon might bill an implant procedure with a CPT surgical code to the patient’s medical insurer. In addition, he will bill routine parts of care, such as the crown placement, using CDT under dental insurance.

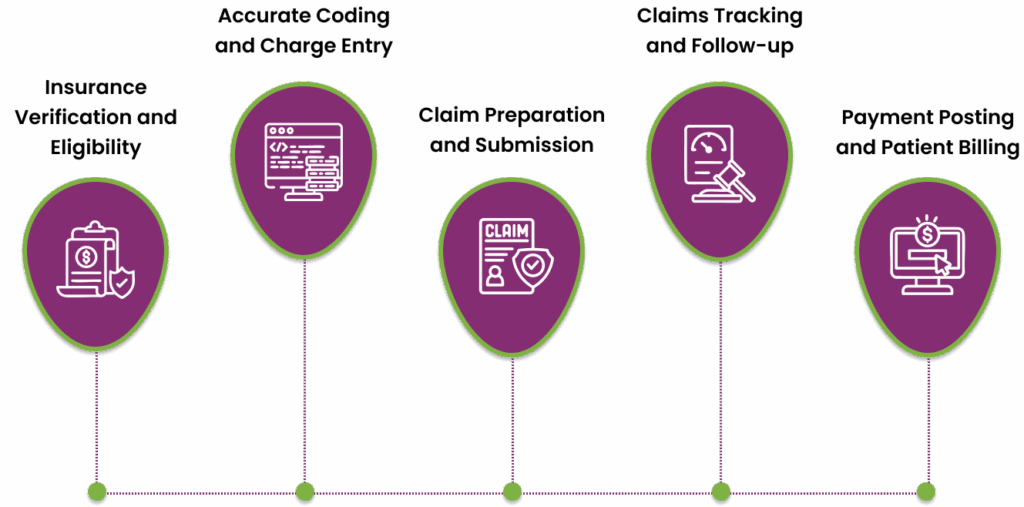

A Complete Guide on How to Perform the Dental Billing Process

The dental billing and coding cycle begins at patient intake and continues through claims follow-up. Below is a workflow outline for dental practices that every biller should follow:

Step 1. Insurance Verification and Eligibility

At registration or prior to treatment, gather complete patient insurance details, including policy numbers and group IDs, and verify coverage online. This step helps the dental billing company confirm active benefits, check frequency limitations, and any waiting periods.

For example, a front-desk team should confirm whether prophylaxis is covered this year and note any unmet deductibles. Documenting all verification results in the patient’s record prevents assuming coverage and helps avoid surprise balances.

Step 2. Accurate Coding and Charge Entry

Once treatment is completed, the provider or outsourced dental billing services provider assigns appropriate CDT codes to every procedure performed. Double-check codes against the current year’s CDT manual.

For instance, a routine adult cleaning is D1110, and a periodic exam is D0120. You have to make sure each code matches the work done, such as a crown might be D2750 and a filling D2330. Enter these codes and charges into the practice management software accurately.

Some of the most commonly used CDT codes include:

- D0120 – Periodic oral evaluation (established patient).

- D0150 – Comprehensive exam (new or established patient).

- D7140 – Extraction, erupted tooth.

- D3310 – Root canal therapy, anterior tooth.

- D6010 – Surgical placement of implant body.

- D8080 – Comprehensive ortho exam for adolescents.

You have to keep the fee schedule updated and re-verify code assignments against payer contracts. Using outdated codes or fee entries can lead to rejections, so annual updates and staff training are recommended.

Step 3. Claim Preparation and Submission

Prepare the ADA Dental Claim Form or electronic claim with patient and provider data. Include patient demographics, dental and subscriber IDs, and provider NPI and tax IDs. On the claim, list all billed CDT codes with corresponding tooth/quad details as needed.

Moreover, always attach any required documentation with the dental billing claim. For example, if a treatment involves pathology, attach X-rays or narratives. Experts suggest attaching all required supporting materials, especially for crowns, extractions, or periodontal procedures.

Step 4. Claims Tracking and Follow-up

After submission, monitor the claim status regularly through your practice software or insurer portals. A best practice is to check each claim at set intervals and immediately address rejections. Top dental billing companies like Transcure advise obtaining submission receipts and saving electronic reports, which help track claims and expedite appeals.

If a claim is denied or unanswered, follow up by phone or electronic inquiry. This ongoing tracking reduces AR days and helps identify patterns, such as repeated rejections for one payer.

Step 5. Payment Posting and Patient Billing

When payments arrive, post them against the patient ledger and note any patient responsibility, such as co-insurance. Moreover, we recommend you review the Explanation of Benefits (EOB) thoroughly. If the payer underpays or misses a procedure, re-bill or submit an appeal.

Finally, bill the patient for any remaining balance with a clear statement. Good patient billing practices, such as transparency of charges and due dates, improve collection.

What are the Common CDT Code Categories?

Dentistry uses the CDT code set, which divides procedures into categories by service type. Below is an overview of each category of dental billing codes with example procedures:

| Category | Code Range | Examples (CDT Codes) |

|---|---|---|

| Diagnostic | D0100 – D0999 |

D0120: Periodic oral evaluation (established patient) D0150: Comprehensive oral exam (new/established) |

| Preventive | D1000 – D1999 | D1110: Prophylaxis, adult cleaning |

| Restorative | D2000 – D2999 |

D2330: Resin-based composite, one-surface, anterior D2140: Amalgam, one-surface, posterior |

| Endodontics | D3000 – D3999 |

D3310: Root canal therapy (anterior) D3220: Pulpotomy (primary teeth) |

| Periodontics | D4000 – D4999 |

D4341: Periodontal scaling (4+ teeth/quad) D4910: Periodontal maintenance |

| Prosthodontics – Removable | D5000 – D5899 | D5213: Partial denture (metal base, resin denture) |

| Implant Services | D6000 – D6199 | D6010: Surgical placement of implant body |

| Prosthodontics – Fixed | D6200 – D6999 | D6245: Pontic, ceramic (final crown) |

| Oral and Maxillofacial Surgery | D7000 – D7999 |

D7140: Extraction, erupted tooth or exposed root D7953: Bone graft, sinus |

| Orthodontics | D8000 – D8999 | D8080: Comprehensive orthodontic treatment (adolescent) |

| Adjunctive General Services | D9000 – D9999 |

D9110: Palliative (emergency) treatment D9940: Occlusal guard adjustment |

An Extensive Code Cheat Sheet for Dental Billing

To support billing tasks, here is a concise cheat sheet of commonly used codes:

CDT Codes

As we know, dental billing services require CDT codes instead of the usual CPT codes. Here is an extensive sheet covering all the common procedures for dental practices.

CDT Codes (Most Common Procedures)

- D0120 – Periodic oral evaluation (established patient)

- D0140 – Limited oral evaluation (problem-focused)

- D0150 – Comprehensive exam (new or established patient)

- D0210 – Full-mouth X-rays (intraoral complete series)

- D1110 – Prophylaxis (adult cleaning) – once per year

- D1120 – Prophylaxis (child cleaning)

- D2330 – Resin-based composite filling, one surface (anterior)

- D2750 – Crown, porcelain/ceramic (it’s the restoration after a root canal)

- D7140 – Extraction, erupted tooth (simple)

- D3310 – Root canal therapy, anterior tooth

- D4341 – Periodontal scaling/root planing (per quadrant)

- D4910 – Periodontal maintenance

- D6010 – Surgical placement of implant body

- D8080 – Comprehensive ortho exam for adolescents

ICD-10 Codes

ICD-10 codes are sometimes requested by medical carriers for dental medical billing services with a medical necessity. Some of the most common diagnosis codes will be discussed in this brief cheat sheet.

ICD-10 Codes (Common Dental Diagnosis)

- K02. – Dental caries (K02.9: Dental caries, unspecified)

- K03. – Other diseases of hard tissues (K03.2: Erosion of teeth)

- K04. – Diseases of pulp and periapical tissues (K04.7: Chronic apical periodontitis)

- K05. – Gingivitis/periodontitis (K05.0: Acute gingivitis, K05.6: Chronic periodontitis)

- K08. – Other disorders of teeth (K08.1: Loss of teeth due to trauma)

- M26. – Temporomandibular joint disorders

- T87.2×1 – Infection following a procedure

HCPCS Codes

Some dental billing and coding services need to use HCPCS codes. Some of these codes used in medical claims for supplies or anesthesia drugs are as follows:

HCPCS Codes (Level II Dental-related)

- D-codes – Essentially HCPCS CDT codes mandated by ADA for HIPAA transactions.

- J-codes – Medications, such as J0120 (Epinephrine 1:1,000), are rarely used.

- A-codes – Supplies, such as A9270 (Non-covered item/service).

CPT Codes

Dentists use these medical billing codes when services are medical in nature. Most of the dental billing services providers use the following CPT Codes:

CPT Codes (Medical Procedure Codes)

- 00170 – General anesthesia for intraoral procedures (use if a patient is fully anesthetized for dental surgery).

- 41899 – Unlisted procedure, jaw (e.g., certain oral surgeries not in CDT).

- 0233T–0237T – Anesthesia for services (Moderate sedation codes for dental applications).

- 29880 – Arthroscopy of the temporomandibular joint.

- 43357 – Temporomandibular joint arthroplasty.

For example, if a patient requires maxillofacial surgery (jaw reconstruction), a surgeon would use the CPT code rather than a D-code. The CPT set is maintained by the AMA.

Before filing a claim, always verify each code description and payer policy. For any dental medical billing services, include the corresponding ICD-10 diagnosis and use the correct CPT code on a medical claim.

What are Some Practical Tips to Follow for Dental Billing?

To minimize denials and expedite payments, we recommend you implement these practical dental billing and coding tips:

- Stay Current on Codes: Always use the latest CDT and CPT code books and electronic updates. The ADA updates CDT annually, so ensure your software is updated each January. Using outdated code is a common denial cause, so try to avoid this issue.

- Thorough Documentation: While doing dental billing, attach all necessary documentation to support claims. For example, X-rays and narratives are often needed for restorative or surgical claims. To avoid any issues, maintain clear chart notes and track tooth numbering and dates to reduce queries.

- Verify Every Plan: Even returning patients may have changed coverage. So, dental billing services providers should confirm benefits at every visit (especially for costly services). This avoids unexpected patient charges and duplicate denials.

- Use Billing Software and Technology: Dental billing and coding companies should leverage their practice management system’s claim editing and submission features. Built-in edits catch missing info (such as diagnosis pointers) before the claim leaves. Opt for electronic claims with integrated attachments to speed processing.

- Outsource or Partner When Needed: If your team is overloaded, consider outsourced dental billing services or partnering with an RCM specialist. Best dental billing companies in New York, Texas, and all bigger states, such as Transcure, offer expert billing support, combining dental coding expertise with efficient follow-up.

- Regular Training and Audits: Conduct frequent staff training sessions on common pitfalls, such as code changes and form requirements. Run internal audits on claim samples to catch issues early.

Conclusion

As we summarize, accurate dental billing services are essential for a financially stable practice. By recognizing how it differs from conventional medical billing, dental billing offices can streamline claims. A thorough billing workflow, from verification through follow-up, coupled with best practices, will eventually minimize denials and boost collections.

To take the burden off your practices, you should look to benefit from expert dental billing companies, such as Transcure, to handle coding and claims efficiently. This dental billing and coding company stays informed on code changes to help maximize reimbursements.

Frequently Asked Questions (FAQs)

Why would a practice outsource dental billing?

Outsourcing dental billing services can reduce administrative burden and improve the overall efficiency of a practice. It allows dental staff to focus more on patient care rather than billing paperwork. Outsourcing can also address staffing challenges and optimize revenue cycle management workflows, often resulting in faster collections.

How can you differentiate between D9310 and D0140?

D0140 is used for a limited oral evaluation that focuses on a specific dental problem or emergency, such as trauma. This evaluation is performed to assess the issue, and any treatment provided afterward is coded for dental billing separately.

On the other hand, D9310 is a consultation code used when a dentist or specialist provides an opinion or advice about a patient referred by another dentist. This code applies when the consultation is requested by another provider for diagnostic purposes or treatment planning.

Where to find the accurate dental billing code?

The most accurate dental billing codes are found in the Current Dental Terminology (CDT) code set, published and updated annually by the American Dental Association (ADA). You can access these codes through the official ADA website, the CDT Code Manual, or trusted dental billing platforms.

Always use the latest version to ensure proper documentation, insurance claims, and reimbursement for dental procedures. Avoid relying on unofficial or outdated sources.