Gastroenterology surgical centers face complex billing challenges, but with clear processes, these can be managed. In fact, BusinessWire’s data shows that overall claim denials remain high, as payors initially denied about 11.8% of claims in 2024. This underscores the need for a detailed and balanced revenue cycle management.

This guide breaks down why GI center billing is different from simple Gastro-enterology billing and how to optimize it, from scheduling to appeals. We will provide actionable strategies and recommend medical billing partners so your center can improve coding accuracy, reduce denials, and accelerate cash flow.

Table of Contents

Toggle- Why Gastro Surgical Center Billing is Different

- Most Billed Gastro Surgical Center Procedures

- Key Financial Metrics for GI Centers

- The End-to-End RCM Workflow for Gastro Surgical Centers

- Common Billing Pitfalls and How to Fix Them

- Practical Coding Cheat Sheet

- Why Outsource GI Surgical Center Billing

- Implementation Checklist for GI Surgical Centers

- Frequently Asked Questions (FAQs)

Why Gastro Surgical Center Billing is Different

GI centers have several billing differences from hospital-based care. For one, most GI procedures are done in Ambulatory Surgery Centers (ASCs) rather than hospital outpatient departments (HOPDs). On the other hand, the latest CMS proposals would add 500 new ASC-eligible codes. In practice, this means GI centers must carefully follow ASC billing rules.

For example, ASCs typically use POS 24, bill a facility fee under ASC payment groups, and employ ASC-specific revenue codes, whereas HOPDs use OPPS rules and POS 19. Reimbursement also differs, as a recent analysis found Medicare facility payments for colonoscopies are roughly 40 to 50% lower in ASCs versus hospitals.

Finally, GI procedures often involve anesthesia or monitored sedation, which brings additional coding complexity. By rule, moderate sedation administered by the endoscopist is generally included in GI procedure CPTs. It means a colonoscopy code by itself includes the GI doctor’s sedation. A separate anesthesia provider (CRNA or anesthesiologist) must bill anesthesia codes if they administer sedation.

Most Billed Gastro Surgical Center Procedures

Gastro surgical centers provide facilities to perform various complex procedures that are hard to bill. A few of these procedures that are regularly performed are:

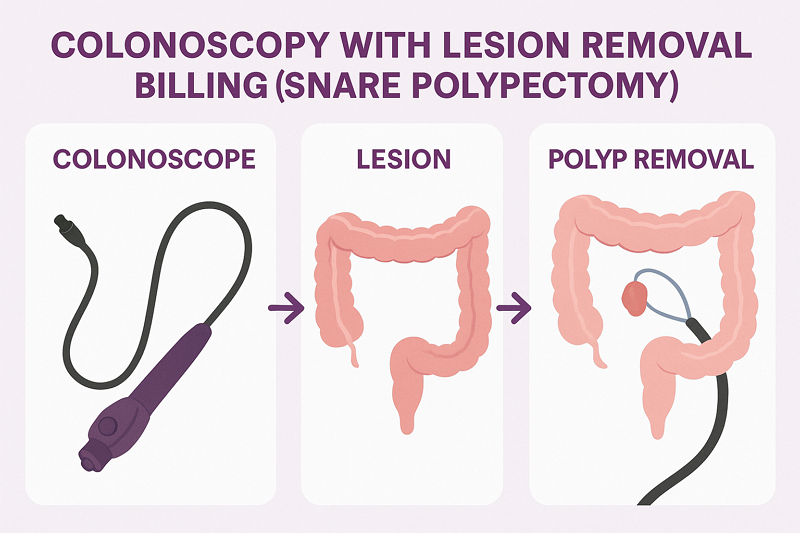

Colonoscopy with Lesion Removal Billing (Snare Polypectomy)

It is one of the most frequent high-revenue GI surgical center procedures. Colonoscopy with Lesion Removal combine routine colonoscopy with the removal of lesions or polyps using a snare (thermal or cold).

For billing, key documentation includes size, number, and location of polyps, snare technique, pathology, and whether the screening colonoscopy turned therapeutic. All of these things affect CPT, ICD-10, and sometimes modifier use (e.g., screening vs diagnostic, “PT” for Medicare).

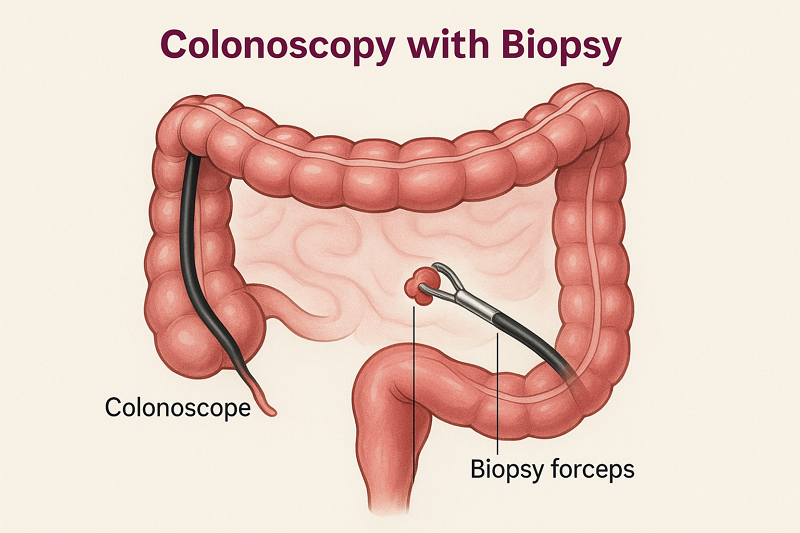

Colonoscopy with Biopsy Billing

Another common procedure that is performed when abnormalities are encountered during screening or diagnostic colonoscopy. Unlike snare polypectomy, which removes tissue in bulk, biopsy refers to taking small samples for pathology.

In billing, this requires detailed biopsy info, clear diagnostic codes, and understanding that sometimes biopsy is bundled or needs modifiers if separate.

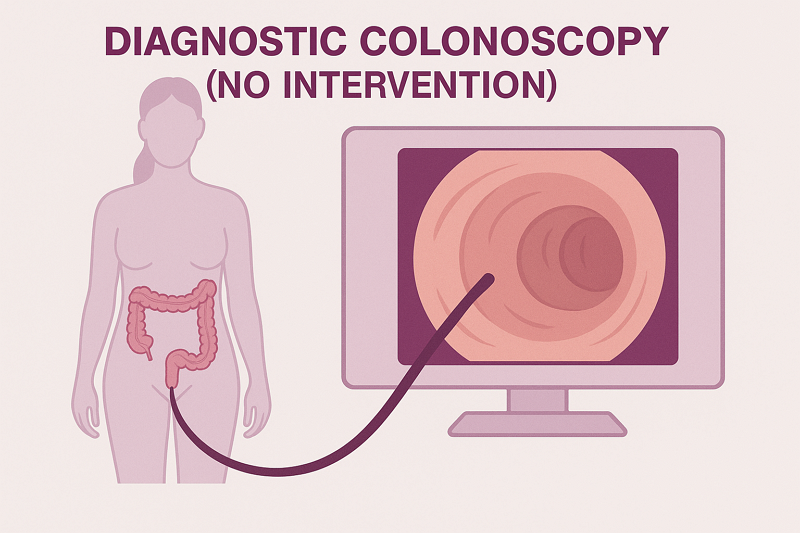

Diagnostic Colonoscopy Billing(No Intervention)

In many cases, colonoscopy is purely diagnostic and is only done to look for issues. It does not involve removing or sampling anything. Billing for this requires using the correct CPT code for diagnostic colonoscopy.

It also needs to be matched with a diagnostic ICD-10 code or symptom code, unless it was scheduled as a screening. Additionally, the biller needs to be very careful about whether the setting is ASC vs hospital.

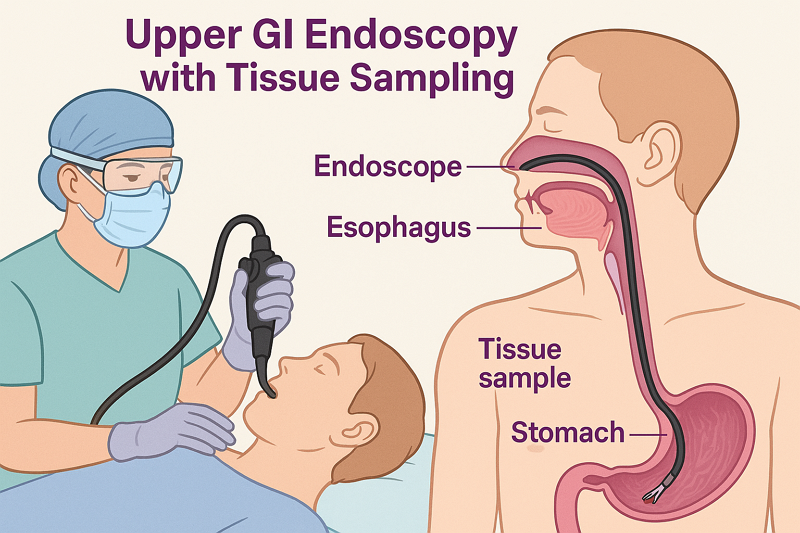

EGD with Biopsy Billing (Upper GI Endoscopy with Tissue Sampling)

This type of procedure is often used for evaluating upper GI issues, such as reflux, bleeding, and ulcers. Billing this involves documenting both the endoscopy and the biopsy, including how many specimens were sampled, what was sampled, and the location.

The important thing here is that the ICD-10 diagnosis must match. Also, other important things include whether anesthesia is included or separate, and to verify payers’ rules for biopsies during EGD.

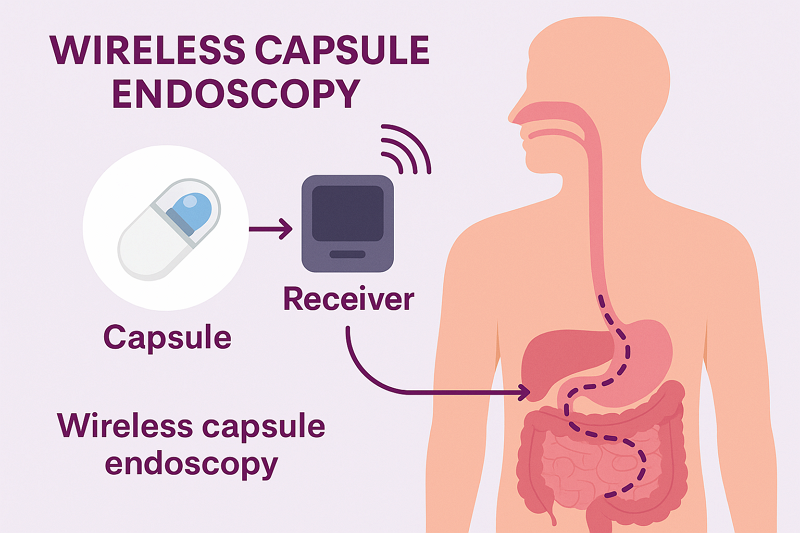

Wireless Capsule Endoscopy Billing

It is less frequent but growing in usage, especially for small bowel evaluation when other scopes can’t reach. Billing capsule endoscopy tends to be more complex because payers, especially Medicare, require dual diagnosis.

This includes the reason for the procedure and the relevant underlying condition, proof that the standard endoscopy was insufficient, and documentation for medical necessity. Apart from that, the use of correct CPT codes, including technical vs professional components, is also important.

Key Financial Metrics for GI Centers

Once you understand the metrics involved, you will better understand the urgency for improvement

- First-pass (Clean) Claim Rate: Percentage of claims paid on first submission. Best practices aim for above 90% first-pass acceptance. A low first-pass rate means extra admin work and delays.

- Denial Rate: Industry benchmarks target less than 5% of claims denied after appeals. Initial denials may be close to 10 to 12%. However, aggressive follow-up should cut that to a single-digit final rate.

- Rework Cost: MGMA studies estimate around $25 to rework a denial and well over $100 to appeal. With denial rates in the double digits, these costs add up and, as a result, correcting 10% of claims could waste thousands per month.

- Days in A/R: Industry standard is less than 30 days. GI centers should closely monitor the percentage of AR above 120 days to keep cash flow healthy.

In short, your practice must aim for an aggressive first-pass rate and quick claim follow-ups. Each percent improvement in first-pass or denial prevention directly increases your revenue.

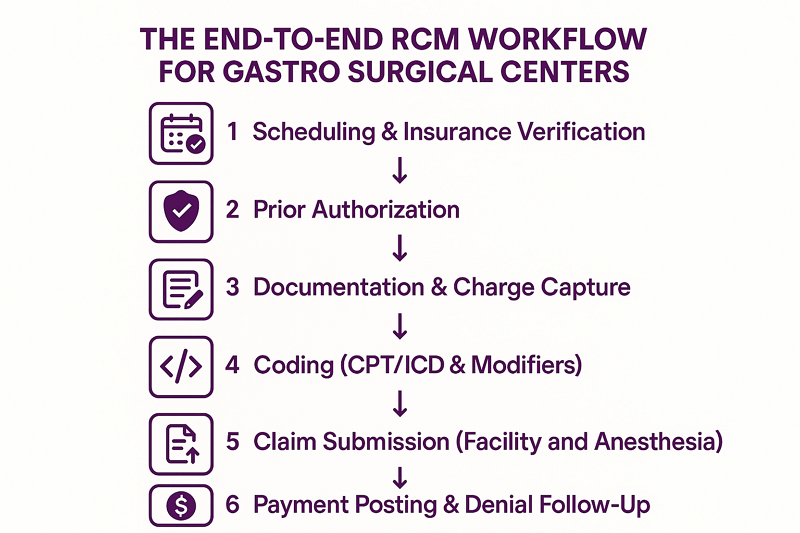

The End-to-End RCM Workflow for Gastro Surgical Centers

You can improve the financial statistics of your practice simply by optimizing the revenue cycle. In general, the RCM and billing workflow for a Gastro Surgical Center goes in the following six steps:

1. Scheduling & Insurance Verification

At scheduling, staff collect patient and insurance info. Verifying eligibility benefits, such as coverage, benefits, co-pay, and any exclusions, upfront is very important. In this way, the provider confirms insurance coverage and ensures that a patient is eligible for services.

It also involves identifying if any GI procedures require prior authorization and educating the patient on payment responsibilities.

2. Prior Authorization

Many GI procedures, especially colonoscopies and high-cost ERCPs, often require insurer pre-approval. If required, staff should submit an authorization request before the procedure begins.

The best practice in this case is to document the service, diagnosis, and reasons in the authorization submission. In this way, getting authorizations and insurance prereqs ahead of time greatly reduces denials for lack of authorization.

3. Documentation & Charge Capture

During the procedure, thorough documentation of everything done is captured in the clinical record. This documentation is the source for coding charges. Charge capture is the process of translating every billable service or supply into the billing system. Studies show providers lose around 1% of potential revenue from missed charge capture alone.

Therefore, always reconcile physician notes with the charge ticket. If a polyp was removed, make sure a polypectomy code is captured. Additionally, use a checklist during recovery to flag any missing charges immediately.

4. Coding (CPT/ICD & Modifiers)

In this step, coders translate the documented procedures into CPT codes and diagnoses into ICD-10 codes, with the appropriate modifiers. It is also true that GI coding can be complex. For example, a colonoscopy with snare polypectomy (CPT 45385) differs from one with biopsy (45380) or no intervention (45378).

Hence, it requires special attention, so always match coding to documentation. If screening vs diagnostic confusion arises, use a screening diagnosis code (Z12.11) for true preventive colonoscopy. It switches to diagnostic ICD if a finding like a polyp emerges.

5. Claim Submission (Facility and Anesthesia)

GI centers typically bill two components, the facility claim and the professional claim. The facility claim includes submission of an ASC claim (UB-04) using the GI facility’s provider number. During billing, use ASC revenue codes tied to the facility fee schedule and only allowable GI ASC procedure codes.

For the second component, you submit the endoscopist’s claim (CMS 1500 form) with a Place of Service (POS) code 24 for ASC. An important point to remember is that a GI physician often performs moderate sedation themselves, which is usually bundled into the endoscopic procedure code. Therefore, the GI provider generally does not bill for separate anesthesia codes.

If an anesthesiologist is used, they will bill their services separately on their own claim using the appropriate anesthesia CPT codes. Anesthesiologists usually bill with their own set of modifiers, such as AA, AD, QK, QX, or QS, depending on their role and the type of anesthesia provided.

6. Payment Posting & Denial Follow-Up

Once payments or remits arrive, post them promptly and reconcile with the billed amounts. Otherwise, any unpaid or denied claims move into follow-up. In this step, a systematic denial-management process is key to recovering revenue.

For example, if colonoscopy claims are repeatedly denied as a “bundled procedure,” you need to adjust future coding. Another suggestion is to keep an automated or manual aging report for outstanding claims. The longer a claim sits unresolved, the less likely full payment becomes.

Common Billing Pitfalls and How to Fix Them

GI specialties often face billing challenges that are not faced by other dedicated specialties. We have provided billing services to GI centers across the U.S. and have found the following recurring issues with their RCM:

- Incorrect CPT Selection: GI has many similar-sounding codes. For example, coding a colonoscopy as purely diagnostic (45378) when a biopsy or polyp was actually removed will trigger a denial. Always match the CPT to the operative report.

- Bundling Errors (NCCI Violations): The National Correct Coding Initiative (NCCI) rules list bundled services that shouldn’t be billed separately. For example, a biopsy taken during a colonoscopy is bundled into the colonoscopy CPT, not a separate EGD.

- Modifier Misuse: Key modifiers in GI include -25, -52, -59, -33, etc. A frequent error is forgetting modifier -25 when a patient receives a significant E/M visit on the same day as a procedure.

- Poor Documentation: Missing details, such as scope insertion depth and locations, not only risk incorrect coding but can also deny claims. Hence, use standardized GI procedure note templates that capture key elements, like indication, anatomical findings, and maneuvers.

- ICD-10 Coding Errors: Every GI claim needs an appropriate diagnosis code. Common mistakes include using a symptom code instead of a definitive finding or confusing screening with surveillance. Always code to the final diagnosis or indication of the service.

- Insurance Verification Oversights: Sometimes, staff assume a service is covered but fail to confirm eligibility or benefits. Especially during billing for GI surgery centers, this can lead to surprise denials or patient balance surprises. That’s why you should check that the insurer covers outpatient endoscopy on that date and does not require authorization.

Apart from the above issues, we have discussed a few more Gastroenterology billing pitfalls in our guide: 5 Uncommon but Serious Gastroenterology Medical Billing Mistakes.

Practical Coding Cheat Sheet

It can become a problem to find the correct codes for the Gastro procedure coding and billing, especially if you’re doing it yourself. We will make this easier for you with the following GI surgical center code cheat sheet:

| CPT Code | Description | ICD-10 Code | Description | Modifier |

|---|---|---|---|---|

| 45378 | Colonoscopy, diagnostic | K21.9 | GERD (gastroesophageal reflux disease) | 25 |

| 45380 | Colonoscopy with biopsy | K29.50 | Gastritis without bleeding | 59 |

| 45385 | Colonoscopy with lesion removal | K30 | Functional dyspepsia | 52 |

| 45388 | Colonoscopy with injection (e.g. polyp) | K31.89 | Other diseases of the stomach/duodenum | 33 |

| 45391 | Colonoscopy with balloon dilation | K50.90 | Crohn’s disease, unspecified | 50 |

| 43235 | EGD (esophagogastroduodenoscopy), diagnostic | K51.90 | Ulcerative colitis, unspecified | 78 |

| 43239 | EGD with biopsy | K57.30 | Diverticulosis of intestine without hemorrhage | 47 |

| 43188 | EGD with dilation (e.g. esophageal) | K62.5 | Hemorrhoids (rectal bleeding) | 22 |

| 43253 | EGD with submucosal injection | R10.9 | Abdominal pain, unspecified | 58 |

| 43260 | ERCP (endoscopic retrograde cholangiography) | Z12.11 | Screening colon cancer | 51 |

| 43263 | ERCP with therapy (e.g., stone removal) | D12.6 | Benign neoplasm of the colon | PT |

| 91110 | Capsule endoscopy (small bowel) | K59.0 | Constipation | — |

| 44379 | Colonoscopy exam via stoma | R19.7 | Diarrhea, unspecified | — |

| 44388 | Endoscopy through the ileostomy or stoma | — | — | — |

| 44389 | Colonoscopy through stoma | — | — | — |

Why Outsource GI Surgical Center Billing

Billing for gastro surgical centers isn’t just about claims submission, as it involves coding complex endoscopic procedures and staying updated with payer-specific LCDs. In-house teams often struggle with compliance, coding accuracy, and constant policy changes.

On the other hand, outsourcing brings specialized expertise and predictable cash flow, which is critical for high-volume GI surgical practices. Outsourcing your billing services also helps save considerable money by eliminating the cost of hosting in-house teams.

Our guide on budgeting your medical billing costs will help you understand this better and save more money. A highly recommended option in this regard is Transcure, a decades-old billing company with over $500 million in processed claims.

TransCure: Your GI Billing Partner

For GI surgical centers looking to outsource or augment billing, TransCure is a specialized partner to consider. We are an end-to-end medical billing company, providing comprehensive billing services to over 40 medical specialties across 50 states. With our extensive experience serving the industry, we achieve a 98%+ first-pass clean claim rate.

Ultimately, your revenue gets up to a 20% boost, and A/R days are cut short by 30%. For GI surgical centers, especially, we implement focused coding audits and catch GI coding nuances, build denial management systems tailored to GI claims, and keep your team audit-ready with documentation reviews. In short, Transcure is certainly the best option to consider to outsource GI surgical centers’ billing and coding.

Implementation Checklist for GI Surgical Centers

If you are stuck with an outdated RCM process and want to streamline it, here is an implementation checklist for quick wins:

First 30 Days

- Assess Current State: Audit your clean claim rate, denial rate, AR days, and workflows. Your goal should be to identify your top 3 denial reasons.

- Staff Training: Run a workshop on GI coding by taking help from a professional. In the workshop, explain concepts like screening vs diagnostic, key modifiers, and documentation requirements.

- Process Fixes: Ensure every upcoming procedure is pre-registered with insurance verified. The best action here would be to start using standardized GI note templates.

- Set Up Tracking: Activate denial tracking tools and AR aging reports. This may cost a few extra bucks on your budget.

30 to 60 Days

- Denial Workflows: Organize existing denials and appeal high-dollar denials first. One thing that helps is to establish a denial follow-up schedule (e.g., daily or weekly denial reviews).

- Documentation Audits: Audit a sample of recent GI charts against claims to catch any coding gaps, such as missed CPTs and missing modifiers.

- Template Refinement: Adjust any EHR templates or forms based on audit findings. Create cheat-sheets for coders with updated GI code edits.

- Metrics Monitoring: Review trends. Aim for a first-pass rate above 90% and push denials under 10% of volume.

60 to 90 Days

- Optimize and Automate: Where possible, implement software solutions for eligibility checks, pre-auth alerts, or code-auditing scripts.

- Engage Payers: Resolve any payer-specific issues, submit credentials for new GI devices, and clarify bundled payments.

- Periodic Reviews: Schedule monthly KPI reviews (denials, A/R days, receivables >120). Compare against targets (denials <5%, A/R 30 to 40 days).

- Continuous Education: Keep coding staff updated on any AMA/CMS coding changes and GI-specific payer edits.

Frequently Asked Questions (FAQs)

What’s the difference between screening vs. diagnostic colonoscopy billing?

A screening colonoscopy is ordered for preventive care in an asymptomatic patient. On the other hand, a diagnostic colonoscopy (patient has symptoms or findings) uses a corresponding symptom/diagnosis code and often results in patient cost-sharing.

How should anesthesia or sedation be billed for GI procedures?

If the GI doctor administers moderate sedation themselves (common practice), this sedation is included in the colonoscopy/EGD CPT code. However, if a separate anesthesia provider administers sedation or general anesthesia, they bill using anesthesia CPTs.

When do I use modifier -25 in GI billing?

Modifier 25 is used on an E/M service that is significant and separately identifiable from a procedure on the same day. In GI, use -25 when the patient receives a distinct office evaluation or consultation on the same visit that also includes a procedure.

What are the global surgery periods for GI procedures?

Most endoscopic GI procedures have 0-day global periods, meaning no post-op days are bundled. The claim includes same-day follow-ups, and the provider can bill for additional E/M visits on other dates as needed.

How do billing rules differ between ASC vs hospital outpatient for GI procedures?

The CPTs themselves are the same in ASC or hospital, but billing rules differ. In an ASC, use ASC-specific revenue codes and follow the ASC fee schedule. The physician’s claim should use POS 24 for ASC, whereas in a hospital, it would be POS 22 or 19.