Overview

Attention Physicians!! Are you struggling to climb the steep slope of financial management and medical billing services within your practice? Revenue Cycle Management, also known as RCM, is here to take away all your worries.

Revenue cycle management services are a financial process that manages the administrative and clinical functions associated with claims processing, payment, and revenue generation. The main goal of RCM is to encompass every step of the patient care process, from the initial appointment to the final payment of a balance.

Considering the benefits of revenue cycle management services, it is crucial to have up-to-date information on the implementation plan. This is why many curious minds search for RCM services updates on search engines, hoping to find accurate and concise answers to their questions.

Hey doc, How about we cut through the noise and put our patients’ needs front and center? This FAQ guide will answer all your questions about implementing RCM and pricing updates. let’s examine each question and its solution.

What are Revenue Cycle Management Services?

Revenue cycle management services are solutions that help healthcare providers manage their financial operations. These services are designed to help healthcare providers maximize their revenue, reduce costs, and improve their efficiency. Revenue cycle management is a broader process encompassing the entire lifecycle of a patient account, from the initial appointment scheduling to the final balance payment. It includes all administrative and clinical functions that contribute to capturing, managing, and collecting patient service revenue.

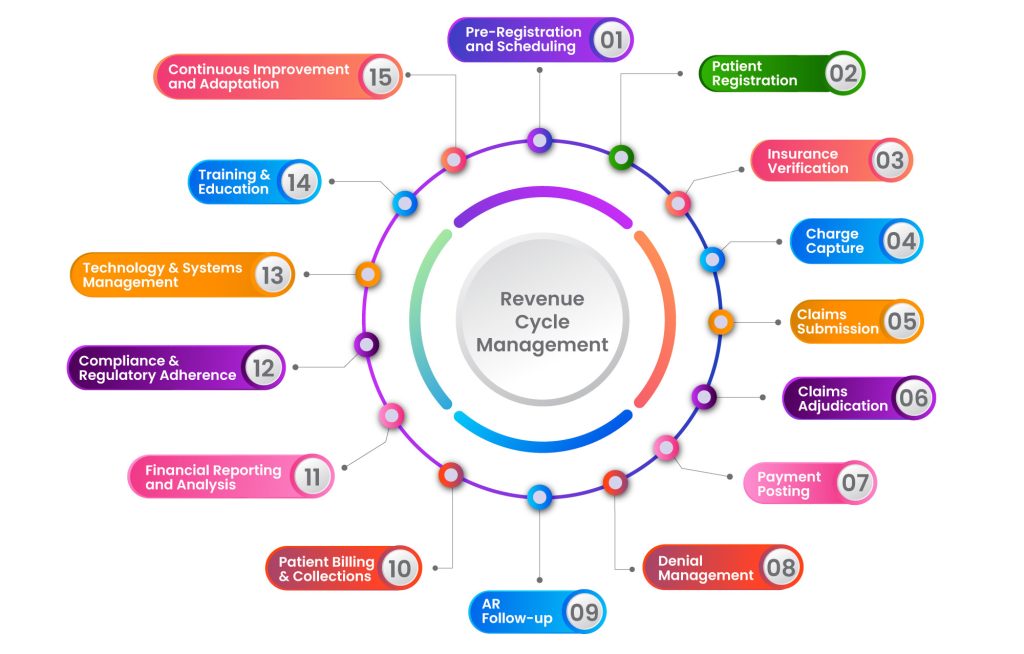

Key Functions

- Scheduling and Registration: Booking appointments and registering patient’s information.

- Eligibility Verification: Checking patient insurance coverage and benefits.

- Charge Capture: Recording services provided and ensuring they are billed accurately.

- Coding and Billing: Assigning appropriate codes and submitting claims for reimbursement.

- Payment Posting: Recording payments received from patients and insurance companies.

- Accounts Receivable Management: Managing outstanding balances and pursuing collections.

Focus of RCM

RCM is concerned with optimizing the entire revenue cycle to maximize revenue and minimize the time between providing services and receiving payment.

Challenges in RCM

- Integration of different systems and software.

- Compliance with healthcare regulations and billing guidelines.

What are the Steps of Revenue Cycle Management Services in Healthcare?

Interested to know how this process works? Buckle up; we’re going to take you through a journey of the stages of revenue cycle management in healthcare.

1. Pre-Registration and Scheduling

Purpose: Gather essential patient information before their visit.

Process: The process of pre-registration and scheduling consists of three simple protocols:

- Collect demographic details and insurance information.

- Confirm appointment availability based on the patient’s preferences and clinic schedule.

- Provide patients with necessary pre-visit instructions, such as fasting or medication restrictions.

Elaboration: This step ensures that the patient’s information is accurate and complete, streamlining the registration process on the appointment day.

2. Patient Registration

Purpose: Officially enter the patient into the healthcare system.

Process: Capture vital information like name, address, contact, insurance, and other relevant details.

Elaboration: Proper registration ensures that the patient’s information is securely stored and easily accessible for future visits.

3. Insurance Verification

Purpose: Confirm the patient’s insurance coverage and eligibility.

Process: Verify insurance details, including coverage, co-pays, deductibles, and any required authorizations. Address any discrepancies or issues with insurance coverage by contacting the payer directly or utilizing online verification tools.

Elaboration: This step helps prevent claim denials and ensures that the patient’s insurance plan covers the services.

4. Charge Capture

Purpose: Document the services provided during the patient’s visit.

Process: Record diagnoses, procedures, and services performed using appropriate codes (ICD-10, CPT, HCPCS).

Elaboration: Accurate coding is crucial for billing and reimbursement, as it determines the amount that will be billed to the payer.

5. Claims Submission

Purpose: Transmit claims to payers for reimbursement.

Process: Submit claims electronically or through paper forms, including supporting documentation and coding details. Attach any required supporting documentation, such as medical records or test results, to the claim for thorough documentation.

Elaboration: This step initiates the reimbursement process and begins the communication between the healthcare provider and the payer.

6. Claims Adjudication

Purpose: Payers review and process the claims.

Process: Payers assess claims for accuracy, completeness, and adherence to their policies. They determine the amount they will reimburse.

Elaboration: This step involves the evaluation of the claim by the payer, which results in either payment, denial, or request for additional information.

7. Payment Posting

Purpose: Record payments received from payers and patients.

Process: Allocate received payments to the corresponding claims or invoices. Identify and allocate payments accurately, distinguishing between insurance payments and patient payments.

Elaboration: Accurate payment posting ensures that the practice’s financial records are up-to-date, reducing the risk of errors or discrepancies.

8. Denial Management

Purpose: Address and rectify denied or rejected claims.

Process: Identify the reason for denial, take corrective action, and resubmit or appeal as necessary.

Elaboration: Effective denial management is crucial for maximizing revenue. It involves identifying common denial reasons and implementing strategies to prevent them.

9. Accounts Receivable (AR) Follow-Up

Purpose: Monitor and pursue unpaid claims and outstanding balances.

Process: Regularly follow up with payers and patients to resolve outstanding claims and balances.

Elaboration: Timely AR follow-up ensures that payments are received promptly, reducing the risk of prolonged revenue cycles.

10. Patient Billing and Collections

Purpose: Generate and send patient statements for any remaining balances after insurance payments.

Process: Offer payment options, establish payment plans, and facilitate collections as necessary.

Elaboration: This step involves communication with patients regarding their financial responsibilities and ensures that the practice receives payment for services rendered.

11. Financial Reporting and Analysis

Purpose: Analyze RCM metrics and KPIs to assess the practice’s financial health.

Process: Evaluate key performance indicators like days in AR, claim denial rates, and collection rates.

Elaboration: Reporting and analysis provide insights into the efficiency and effectiveness of the RCM process, enabling informed decision-making.

12. Compliance and Regulatory Adherence

Purpose: Ensure adherence to healthcare regulations, including HIPAA, billing and coding guidelines, and payer-specific policies.

Process: Conduct regular audits to ensure billing and coding practices align with industry regulations and compliance standards.

Elaboration: Compliance with industry regulations is critical to avoid legal issues and maintain the integrity of the revenue cycle process.

13. Technology and Systems Management

Purpose: Utilize healthcare information systems (EMRs, billing software) for efficient RCM processes.

Process Regularly update and maintain healthcare information systems to ensure they meet current security and functionality standards.

Elaboration: Proper management of technology and systems streamlines RCM, ensuring accurate record-keeping and efficient workflow.

14. Training and Education

Purpose: Provide ongoing training for staff on RCM best practices, coding updates, compliance requirements, and technology usage.

Process: Provide ongoing training on privacy practices, security protocols, and compliance requirements to protect patient information.

Elaboration: Well-trained staff contribute to the accuracy and effectiveness of the RCM process, reducing errors and improving revenue capture.

15. Continuous Improvement and Adaptation

Purpose: Stay updated with changes in healthcare policies, coding guidelines, and payer requirements.

Elaboration: Remaining adaptable and responsive to industry changes is vital for maintaining an efficient and effective revenue cycle process.

Remember that RCM is a dynamic process, and practices may adapt or refine these steps based on specific needs, technological advancements, and industry updates in 2023 and beyond.

What is the Difference Between Medical Billing Services and Revenue Cycle Management Services (RCM Services)?

| Medical Billing VS Revenue Cycle Management Services | ||

|---|---|---|

| Aspect | Medical Billing Services | Revenue cycle management services |

| Definition | Submission and follow-up of insurance claims | Comprehensive management of patient accounts |

| Scope | A narrow focus on claims submission and follow-up | Broader, covers the entire patient revenue cycle |

| Primary Focus | Timely and accurate claim submission | Maximizing revenue and minimizing payment delay |

| Challenges | Keeping up with coding and billing regulations Dealing with denials and appeals | Integration of different systems and software Compliance with healthcare regulations |

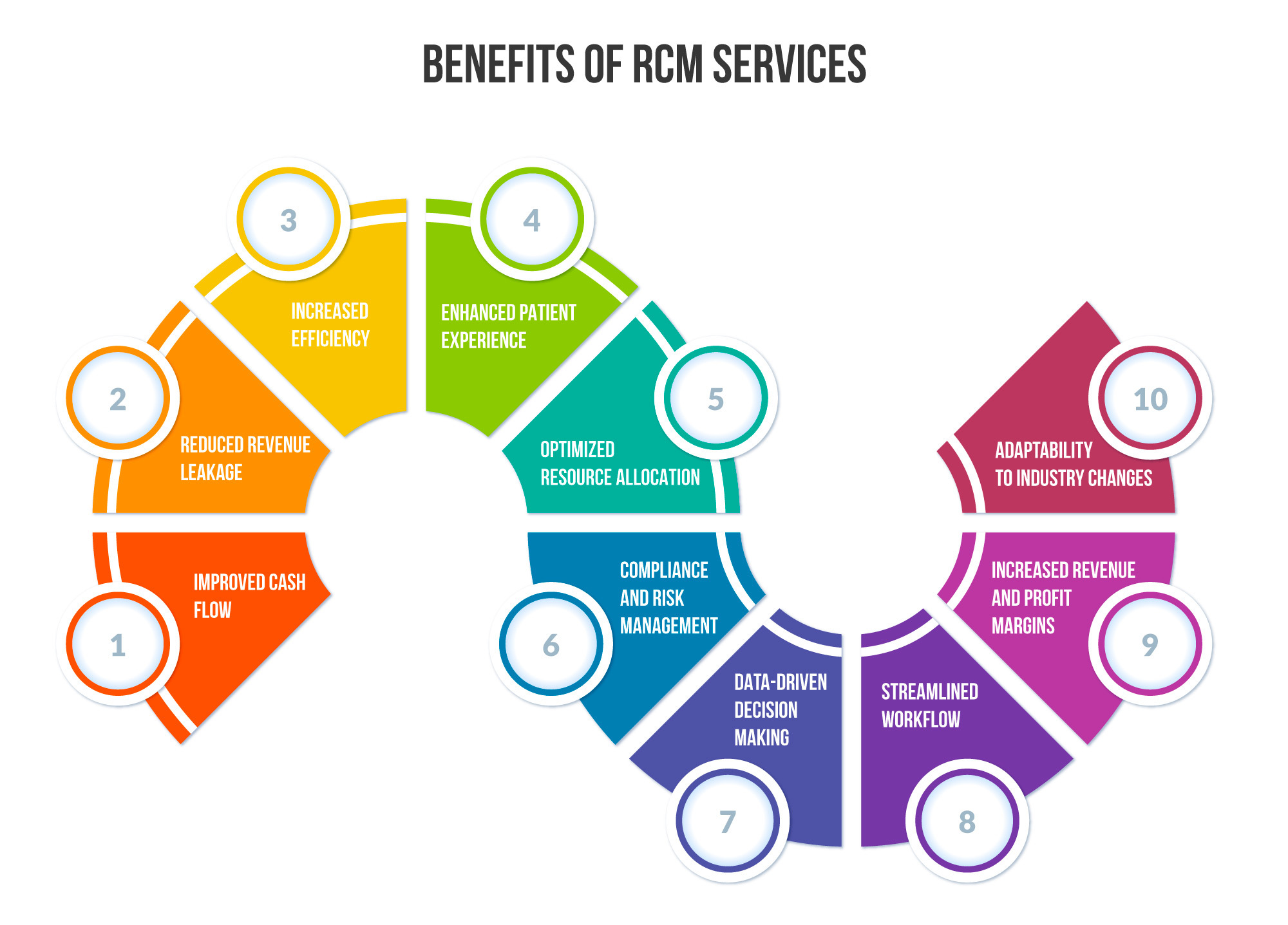

What are the Benefits of Revenue Cycle Management Services?

Implementing an effective Revenue Cycle Management (RCM) system offers healthcare providers and organizations several benefits. These benefits include:

Improved Cash Flow: RCM streamlines the billing and collection process, reducing the time it takes to receive payments. This leads to a more consistent and predictable cash flow for the healthcare organization.

Reduced Revenue Leakage: Top-notch revenue cycle management services help identify and rectify issues such as under-coding, missed charges, and billing errors. This minimizes revenue losses and ensures that providers are appropriately compensated for their services.

Increased Efficiency: RCM automates many aspects of the revenue cycle, reducing manual work and administrative overhead. This allows staff to focus on patient care rather than paperwork.

Enhanced Patient Experience: A well-managed revenue cycle leads to accurate billing and fewer billing-related inquiries from patients. This can improve patient satisfaction and trust in the healthcare provider.

Optimized Resource Allocation: RCM helps identify areas where resources can be allocated more effectively. For example, it can highlight the most profitable services and where operational improvements are needed.

Compliance and Risk Management: RCM systems are designed to adhere to industry regulations and compliance standards. This reduces the risk of penalties and legal issues related to billing and reimbursement.

Data-Driven Decision Making: RCM generates detailed reports and analytics about the organization’s financial health. This data can be used to make informed decisions about resource allocation, strategic planning, and process improvements.

Improved Patient Engagement: RCM often includes tools for patient engagement, such as online bill payment and cost estimation tools. This empowers patients to take an active role in their healthcare finances.

Streamlined Workflow: By integrating scheduling, billing, coding, and payment processes, RCM creates a more seamless and efficient workflow. This reduces delays and bottlenecks in the revenue cycle.

Increased Revenue and Profit Margins: Effective RCM billing services lead to higher collection rates, fewer claim denials, and better accounts receivable management, ultimately leading to increased revenue and higher profit margins for the healthcare organization.

Adaptability to Industry Changes: RCM billing services are designed to adapt to changes in healthcare regulations, coding guidelines, and payer policies. This ensures that the organization remains compliant and financially sustainable in a dynamic healthcare landscape.

Overall, a well-implemented RCM system is crucial for healthcare providers’ financial health and sustainability, allowing them to focus on delivering high-quality patient care.

What Factors Affect the Price of Revenue Cycle Management Services in Healthcare?

In the intricate realm of healthcare, the pricing of Revenue Cycle Management (RCM) services is a tapestry woven from various threads. Understanding the pivotal factors that sway these costs is paramount for healthcare providers seeking seamless financial operations. Let’s embark on a journey through the elements that shape the price of revenue cycle management services.

1. Scope and Complexity of Services

The breadth and intricacy of revenue cycle management services required play a pivotal role in determining costs. Comprehensive services encompassing billing, coding, claims processing, denial management, and compliance adherence tend to command higher fees.

2. Technology Infrastructure

Cutting-edge technology is the backbone of modern revenue cycle management services. Sophisticated software, EMR/EHR integration, and AI-powered tools can enhance efficiency and accuracy and contribute to the overall cost.

3. Regulatory Compliance and Reporting

The healthcare landscape is perpetually evolving. RCM billing service providers must stay attuned to myriad regulatory requirements influencing pricing structures, including HIPAA, MACRA, and MIPS.

4. Volume and Operational Scale

The scale at which a healthcare facility operates is a pivotal factor. Large, multi-specialty facilities with high patient volumes may require more extensive revenue cycle management services, impacting pricing.

5. Customization and Specialization

Tailored RCM solutions designed to meet specific needs or cater to specialized medical practices may incur additional costs. Personalized approaches often require extra attention and expertise.

6. Staffing and Expertise

The caliber of RCM professionals, expertise, and involvement in the process significantly influence pricing. Highly skilled teams with specialized knowledge may come at a premium.

7. Outsourced vs. In-House RCM

Choosing between outsourcing revenue cycle management services or managing them in-house is crucial. Outsourcing often offers cost efficiencies due to economies of scale, but the level of control may vary.

8. Geographical Location

Regional disparities in labor costs and market dynamics can lead to variations in pricing. Urban centers may command higher fees compared to rural areas.

9. Contract Terms and Service Level Agreements (SLAs)

The nature of the contract, including the scope, duration, and performance metrics outlined in SLAs, can impact pricing. Long-term commitments may yield cost savings.

10. Provider Reputation and Track Record

Established RCM billing service providers with a proven track record and a reputation for delivering results may charge a premium for their expertise and reliability.

11. Data Security and Compliance Measures

In an era of heightened data protection concerns, RCM billing service providers investing in robust security measures may factor these costs into their pricing.

Understanding these influential factors empowers healthcare providers to make informed decisions regarding their revenue cycle management services. By carefully evaluating these elements, providers can strike a harmonious balance between cost-effectiveness and optimal financial performance in the ever-evolving healthcare landscape.

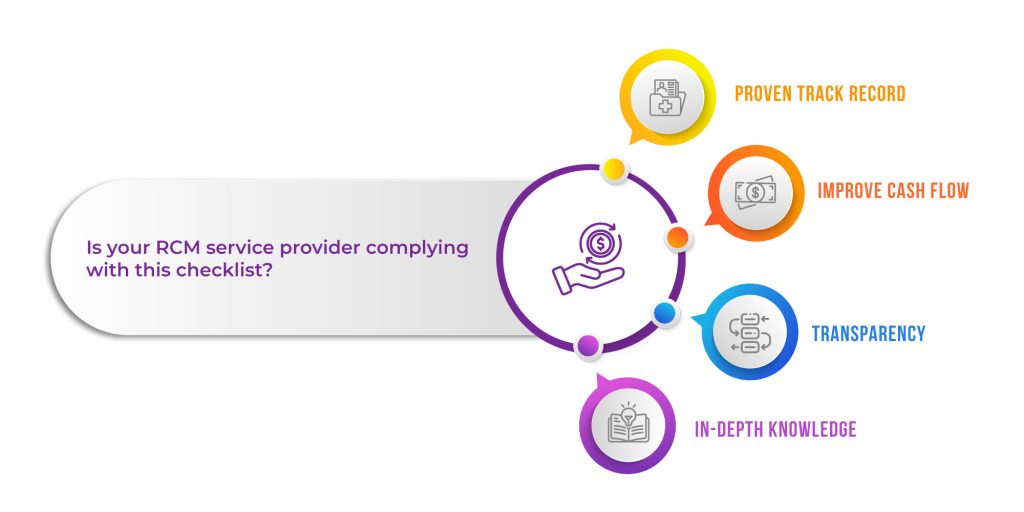

What Should I look for when Outsourcing Revenue Cycle Management Services?

RCM is an operational best practice for any healthcare provider. Best Practices in Revenue Cycle Management ensure reduced operational costs, increased collections, and a streamlined billing process. While choosing a company for revenue cycle management services, you should follow the following checklist:

- Proven Track Record: revenue cycle management services help providers increase reimbursements and gain financial strength

- Improve Cash Flow: With a 98% clean claims rate, boost revenues from the same practice.

- Transparency: A dedicated team shares each and every aspect of RCM billing services with your office staff.

- In-depth Knowledge: RCM experts have in-depth knowledge of how to make practice profitable.

How Much do Revenue Cycle Management Services Cost?

The cost of Revenue Cycle Management (RCM) services in healthcare can vary widely based on several factors, including the size and complexity of the healthcare practice, the range of services provided by the RCM company, and the specific needs of the practice.

Percentage of Collections

Many RCM companies charge a percentage of the total collections they generate for the practice. This percentage typically ranges from 4% to 8% of the practice’s collections.

Flat Fee per Provider per Month

Some RCM companies charge a fixed fee per provider per month. This fee can range from $500 to $1,500 per provider.

Hourly Rates

In some cases, RCM services may be charged hourly. Rates can range from $25 to $100 per hour, depending on the expertise required.

Tiered Pricing

Larger practices with higher claims volumes may negotiate tiered pricing structures that offer discounts based on the volume of claims processed.

Additional Services

Extra services like credentialing, compliance consulting, and financial reporting may incur additional charges.

Start-up and Implementation Fees

Some RCM companies may charge a one-time fee to cover the costs of setting up and integrating their services with the practice’s existing systems.

Software Costs

Additional licensing or subscription fees may exist if the RCM company provides specialized billing and claims management software.

Customization and Specialized Services

Practices with unique needs or specialized services may require customized solutions, impacting the overall cost.

Will Investing in Revenue Cycle Management Services (RCM Services) Make us a Better Practice?

Investing in revenue cycle management services (RCM Services) can significantly improve your healthcare practice’s overall efficiency and financial health. Here are several ways RCM services can benefit your practice:

Enhanced Financial Predictability

RCM services provide accurate forecasting of revenue streams, allowing for better financial planning and resource allocation within your practice.

Reduced Billing Errors and Rejections

Expert RCM professionals can significantly decrease the occurrence of billing errors and claim rejections, leading to smoother revenue cycles and fewer disruptions.

Comprehensive Reporting and Analytics

RCM companies often offer robust reporting tools, providing valuable insights into your practice’s financial performance and areas for potential improvement.

Increased Staff Productivity

Outsourcing RCM services allows your in-house staff to focus on patient care and other critical tasks, resulting in heightened productivity and job satisfaction.

Mitigated Compliance Risks

RCM experts stay abreast of ever-changing healthcare regulations, ensuring that your practice remains compliant and avoids costly penalties or legal issues.

Improved Patient Engagement

Streamlined billing processes lead to clearer communication with patients about their financial responsibilities, fostering trust and positive relationships with your practice.

Tailored Revenue Strategies

RCM services can develop customized strategies based on your practice’s unique needs and objectives, maximizing revenue potential in alignment with your specific goals.

Swift Claim Resubmission and Follow-Up

RCM professionals excel at promptly addressing denied claims, accelerating resolution and optimizing reimbursement for your practice.

Access to Cutting-Edge Technology

Many RCM companies invest in advanced billing software and technology, ensuring your practice benefits from the latest tools and automation capabilities.

Scalability and Growth Opportunities

RCM services can adapt to your practice’s evolving needs and size, providing a flexible solution that supports expansion and increased patient volume.

Proactive Revenue Protection

RCM experts can identify potential revenue leakage points and implement preventive measures to safeguard against financial losses.

Enhanced Provider-Patient Relationships

With the administrative burden lifted, providers can allocate more time and attention to patient interactions, ultimately leading to higher patient satisfaction and loyalty.

Investing in RCM services in healthcare can lead to a more efficient, financially stable, and patient-centric practice. It allows you to concentrate on what you do best – providing excellent healthcare – while experts manage the intricacies of revenue cycle management. This, in turn, can contribute to your practice’s long-term success and growth.

Will the Billing Company Analyze and Track All of my Rejected Claims?

Yes, a reputable company will provide top-notch revenue cycle management services and analyze and track your rejected claims as part of its comprehensive services. This is a crucial aspect of RCM services in healthcare. Here’s how they typically handle rejected claims:

Analysis of Rejected Claims

RCM services companies have dedicated teams that scrutinize each rejected claim closely. They investigate the reason for rejection, which could be due to errors in coding, missing information, or other billing discrepancies.

Identifying Patterns and Trends

They use advanced analytics and reporting tools to identify recurring patterns or trends in claim rejections. This helps in addressing systemic issues that may be leading to rejections.

Corrective Action Plans

Based on the analysis, the RCM company will develop specific corrective action plans to rectify the issues causing claim rejections. This may involve correcting coding errors, obtaining additional documentation, or re-submitting claims with the correct information.

Resubmission of Claims

The RCM company will take responsibility for re-submitting corrected claims to the respective payers. They ensure that all necessary information is provided to increase the likelihood of claim acceptance.

Follow-Up on Revised Claims

After re-submission, the RCM company will closely monitor the status of the claims to ensure they are processed and paid in a timely manner.

Documentation and Reporting

Detailed records are maintained for all rejected claims and actions taken to rectify them. This documentation helps in tracking progress and identifying areas for further improvement.

Feedback and Education

The RCM company may provide feedback to your practice regarding common reasons for claim rejections. They may also offer training or education on best practices to prevent future rejections.

Continuous Improvement

The RCM company works towards minimizing claim rejections over time through ongoing analysis and feedback. This contributes to a more efficient revenue cycle process. Your healthcare practice benefits from its expertise and resources by entrusting the analysis and tracking of rejected claims to an experienced RCM services company. This allows your staff to focus on patient care while the RCM experts handle billing and claims management complexities.

Effective rejection management is crucial to maximizing revenue and maintaining a healthy financial outlook for your practice. Choosing an RCM company with a proven track record in this area is important.

Final Thought

Now that you are aware of revenue cycle management services, you are probably wondering, “How can I implement these services in my practice?”

ACT NOW!

Hire us, a professional medical billing company, and let our revenue cycle management services help you optimize your practice’s profitability. Reach out now and gain access to a seamless, efficient, and robust RCM process tailored to meet your needs. Let the experts handle your medical billing while you focus on what matters the most – providing excellent patient care!