Table of Contents

ToggleOverview

Being burdened with a hefty backlog of accounts receivable can be a significant headache for practitioners. Not receiving the financial compensation they rightfully deserve, despite giving their best in patient care, can be frustrating for anyone. If you are struggling with it, have you ever wondered what the root cause of an unrecovered account receivable could be? If these questions pop up in your thoughts and distract your attention from patient care, then you are at the right place. This blog is packed with proven accounts receivable (A/R) recovery strategies. Additionally, it explores how internal medicine practices can adopt innovative approaches to maximize their recovery potential and maintain a competitive edge.

What Are Accounts Receivable in Healthcare?

Accounts receivable in healthcare are the money owed to a healthcare provider by patients or insurance companies for the treatment they have received. AR recovery is the process of collecting payments from these entities. Healthcare providers can improve their recovery success rate by implementing new strategies and increasing revenue.

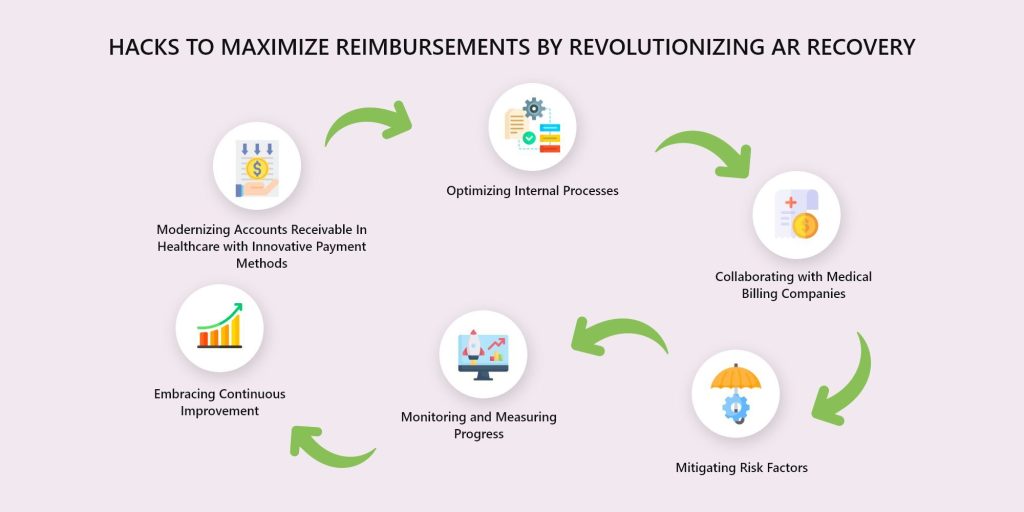

Modernizing Accounts Receivable In Healthcare with Innovative Payment Methods

To revolutionize AR recovery, embracing innovative payment methods that cater to customers’ changing needs is crucial. By offering diverse payment options such as credit cards, e-wallets, and mobile payments, practices can enhance the convenience and flexibility of their payment processes, leading to faster recovery and increased customer satisfaction.

Leveraging Online Payment Portals and Integrated Systems

One key edge-cutting strategy is to leverage online payment portals and integrated systems. By implementing user-friendly payment portals seamlessly integrating with customer relationship management (CRM) systems, practices can streamline their recovery process, saving time and minimizing errors.

Digital Wallets and Contactless Payment Options

Digital wallets and contactless payment options have revolutionized the way transactions take place. By embracing these technologies, practices can enhance the efficiency of their AR recovery. With just a tap or a scan, customers can swiftly make payments, reducing the time for funds to reach the business and expediting recovery.

Optimizing Internal Processes

Practices need to optimize internal processes to improve the recovery of accounts receivable in healthcare practices. By streamlining their internal operations, they can significantly enhance their recovery capabilities.

Enhancing Invoicing and Billing Systems

Improving invoicing and billing systems is vital for efficient AR recovery. Practices can minimize payment delays and reduce disputes by ensuring accurate and timely invoices. Utilizing automation to generate invoices, implement electronic billing, and provide detailed transaction information can help streamline recovery.

Integrating AR Recovery with Accounting and ERP Systems

Integrating AR recovery with accounting and enterprise resource planning (ERP) systems can lead to significant improvement. This integration gives practices real-time access to financial data, allowing them to promptly monitor outstanding payments, identify bottlenecks, and recover funds.

Collaborating with Medical Billing Companies

To boost AR recovery, practices should consider collaborating with external debt collection and recovery billing companies. Partnering with reputable medical billing companies can positively impact recovery rates.

The Role of Outsourced Medical Billing Companies in AR Recovery Improvement

Outsourced medical billing companies in the USA have the potential to bring extensive expertise and resources to the table. These entities possess in-depth knowledge of collection practices, legal requirements, and negotiation techniques to effectively recover overdue payments with their expertise, improving recovery rates and focusing on their core operations.

Identifying and Partnering with a Reputable Billing Company

Thoroughly researching and identifying reputable collection agencies is crucial for successful collaboration. Partnering with agencies with a proven track record is essential, as understanding the specific industry and aligning with the business’s values and objectives is vital. Companies can enhance recovery results and maintain a positive brand image by selecting the right agency.

Maximizing the Benefits of Outsourcing AR Recovery

Outsourcing accounts receivable recovery to external agencies can provide various benefits. By entrusting the recovery process to experts, practices can save time, effort, and resources. Additionally, external agencies often have access to advanced technologies, more extensive networks, and specialized tools, enabling them to recover funds more efficiently.

Mitigating Risk Factors

Minimizing the risks associated with bad debt and unpaid invoices is crucial for effective accounts receivable management. By implementing risk mitigation strategies, practices can prevent financial losses and maintain a healthy cash flow.

Conducting Thorough Credit Checks and Scoring

Before extending credit to customers, conducting thorough credit checks and scoring can help Practices assess the creditworthiness of potential clients. Practices can make informed decisions by evaluating factors such as payment history, financial stability, and industry reputation, reducing the risk of unpaid invoices.

Employing Credit Insurance and Factoring Services

Credit insurance and factoring services provide Practices with additional protection against non-payment. Credit insurance safeguard practices can cover unpaid invoices due to customer insolvency or default. Factoring services allow practices to sell their accounts receivable to a third-party company, immediately providing cash flow while transferring non-payment risk.

Monitoring and Measuring Progress

To continuously drive improvement in AR recovery, practices must establish effective metrics and key performance indicators (KPIs) to monitor progress.

Implementing Effective Metrics and KPIs for AR Management

Measuring recovery ratios, aging reports, and collection efficiency are essential metrics that practitioners can leverage. By analyzing these metrics regularly, they can identify trends, spot areas for improvement, and take proactive measures to optimize their AR recovery strategies.

Analyzing Recovery Ratios and Aging Reports

Recovery ratios and aging reports allow Practices to gauge the effectiveness of their AR management efforts. Recovery ratios measure the percentage of outstanding debt successfully recovered while aging reports track the time for invoices to be paid. Regularly analyzing these reports enables practices to identify bottlenecks and tailor their recovery strategies accordingly.

The Power of Real-Time Insights for Continuous Improvement

Real-time insights from cutting-edge technologies and data analytics provide practices with valuable information to facilitate continuous improvement. By leveraging real-time insights, the bus can adapt its strategies, detect irregularities, and implement measures to expedite recovery.

Embracing Continuous Improvement

A culture of continuous improvement is essential for practices to adapt to changing dynamics and consistently enhance their AR recovery practices.

Evolving Strategies for Changing Market Dynamics

Market dynamics are constantly evolving, and practices must develop with them. As customer preferences, payment methods, and economic conditions change, practices must adjust their strategies accordingly. By staying proactive and flexible, practice can remain ahead of the curve and maximize its AR recovery potential.

Establishing a Culture of Continuous Improvement

Creating a culture of continuous improvement requires leadership commitment, employee engagement, and the integration of improvement processes into everyday operations. By encouraging innovation, collaboration, and open communication, practices can foster an environment where AR recovery improvement is consistently pursued.

The Importance of Learning and Adaptation in AR Recovery for Internal Medicine

Learning from past experiences and continuously refining recovery strategies is vital. Practices should proactively seek feedback, monitor market trends, and stay updated on industry best practices. By embracing a culture of learning and adaptation, practices can remain agile and optimize their AR recovery efforts.

Conclusion

In conclusion, adopting effective strategies for improving AR recovery is essential for internal medicine practices aiming to improve financial performance. By embracing innovative payment methods, optimizing internal processes, collaborating with external agencies, mitigating risk factors, monitoring progress, and adopting continuous improvement, practices can unlock the potential for transformation in their AR recovery practices.

FAQs Answered By Transcure Team

What is AR Recovery, and Why is it Crucial for Practices?

AR recovery is identifying and collecting payments from patients who have either not paid or have not paid in full. It is crucial for practices because it helps them maximize their revenue and operational efficiency.

How Can Technology Revolutionize AR Recovery Processes?

Automated processes powered by advanced technologies such as artificial intelligence and machine learning can help practices quickly and accurately identify and collect unpaid claims. This can lead to improved cash flow and better accounts receivable management, ultimately leading to improved revenue.

How Does Effective Communication Play a Role in Enhancing AR Recovery?

Effective communication is essential for improving AR recovery because it enables businesses to track their accounts receivable more effectively, set clear payment terms and expectations with customers, and keep customers informed about any changes in the payment process. It helps ensure that payments are made on time, improving cash flow, better accounts receivable management, and enhancing revenue.

What Are Some Best Collection Practices to Improve AR Recovery Rates?

The best collection practices to improve AR recovery rates include:

- Setting up automated payment reminders.

- Offering flexible payment options.

- Encouraging early payments with discounts.

- Having a dedicated team of collection specialists to follow up with customers.

How Can Practices Cultivate Strong Customer Relationships for AR Recovery?

Practices that cultivate strong customer relationships for AR Recovery include:

- Being proactive in communicating with customers.

- Being responsive to customer inquiries.

- Listening to customer feedback.

- Engaging in customer education.

By ensuring customers have a positive experience, practices can build trust and loyalty, leading to higher recovery rates.

How Can Internal Processes be Optimized to Streamline AR Recovery?

Streamlining processes can reduce manual errors and time delays, ensure that customers are contacted on time, and ensure that communication is clear and respectful. Automating specific processes can also reduce manual workload, freeing resources to focus on more complex tasks.

What Strategies Help Mitigate Risks Associated With Unpaid Invoices?

Strategies such as automating invoice processing, integrating invoice data with accounting systems, utilizing electronic payments, implementing invoice reminders, and utilizing third-party collections services can all help to mitigate the risks associated with unpaid invoices.