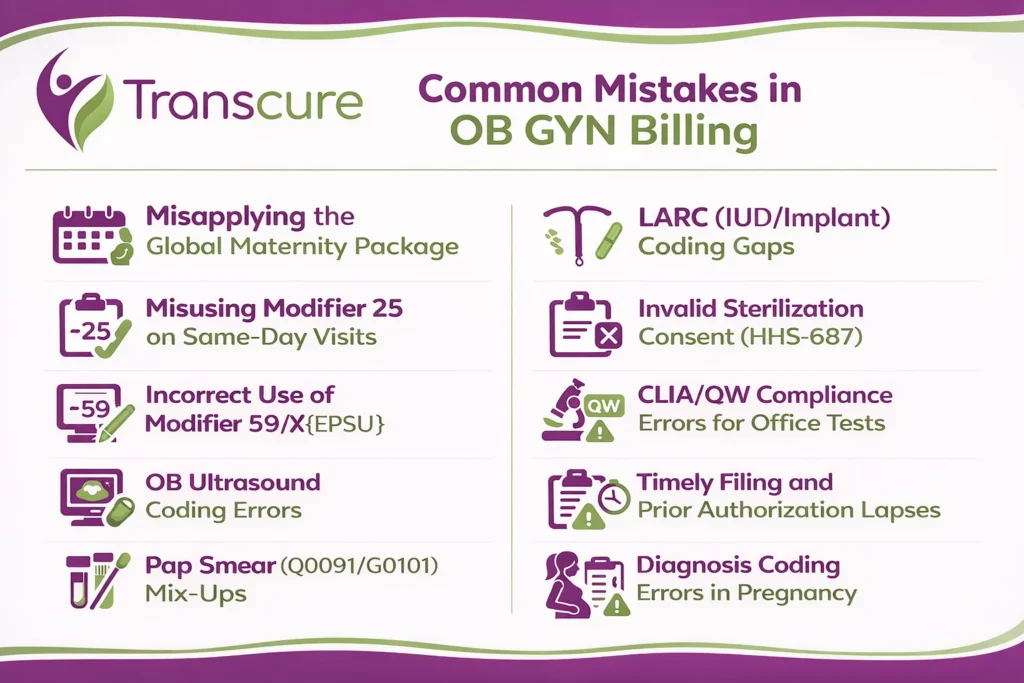

OB/GYN billing is uniquely complex due to global maternity packages, bundled services, and specialty procedures. For example, Medicare’s global obstetric codes, like CPT 59400, 59510, cover routine antepartum care, delivery, and postpartum visits, but exclude many add-on services. Confusion over what is “bundled” versus billable separately, including anesthesia/pain management and ancillary labs, frequently leads to errors.

Even small coding and modifier errors can trigger denials. One analysis found nearly 1 in 5 OB/GYN claims are denied due to routine billing mistakes, which drives the need for dedicated medical billing services for ObGyn practices. This guide highlights ten common OB-GYN billing errors, explains the rules behind them, and offers practical steps to prevent costly mistakes.

Table of Contents

ToggleMistake 1: Misusing Modifier 25 on Same-Day Visits

Modifier 25 is often applied incorrectly on day-of-procedure visits. Billers may forget to append -25 when a patient’s condition requires a separate evaluation on the same day as a minor procedure, or they may overuse it without justification. Underusing modifier 25 means losing significant reimbursements, while overuse can lead to audits.

What to Know

- Modifier 25 denotes a “significant, separately identifiable” E/M service on the same day as another procedure. It should only be used when the patient’s condition requires additional work beyond the usual pre/post-procedure work.

- Do not attach -25 to every visit with a procedure. The medical record must show a distinct clinical problem and medical decision-making for the E/M portion. Simply seeing a patient for a routine follow-up on a procedure day does not qualify.

- CMS and AMA guidelines stress that 25 is reserved for separate visits, so improper use can lead to denials or audits.

How to Avoid It

- Train staff and providers regularly on Modifier 25 criteria. Moreover, consider outsourcing ob gyn billing services for correct modifier usage.

- Improve provider-biller communication. Coders should review notes and query providers if it’s unclear whether an office E/M was distinct from the procedure.

- Audit usage periodically. Use your billing system to flag when an E/M was billed without 25 on a procedure day or vice versa, and verify the documentation supports the modifier.

Mistake 2: Incorrect Use of Modifier 59/X{EPSU}

Appending modifier 59 (or one of the newer X{EPSU} modifiers) to bypass bundling edits is a common mistake. This happens when coders use 59 simply to force payment on two same-day services that normally bundle together. Payers see this as abusive or unsupported and often deny or recoup payment.

What to Know

- Modifier 59 should only be used when two procedures are truly distinct, and no other modifier applies. For clarity, CMS prefers the “X” modifiers: XE (separate encounter), XS (separate structure), XP (separate provider), XU (unusual non-overlapping).

- Always review National Correct Coding Initiative (NCCI) edits first. If two codes normally bundle, you need strong justification and documentation of distinctness.

- Incorrectly forcing payment with -59 invites audits and refunds, especially if the services were actually part of the same global package.

How to Avoid It

- Enable NCCI edits in your billing scrubber. When a bundling conflict is flagged, require a note or alert for claims sent with modifier 59/X.

- Document justification carefully. If using -59 or an X-modifier, note the clinical reason in the claim, so that auditors can verify the separation.

- Prefer the specific X{EPSU} modifier when appropriate. For example, use XS if the same procedure was done on two different practitioners or body structures, and document that scenario.

Mistake 3: OB Ultrasound Coding Errors

OB practices frequently miscoded ultrasounds. Common errors include choosing the wrong CPT or failing to document all required elements. Payers will downcode or deny claims when the report doesn’t support the billed code.

What to Know

- CPT 76805 (standard 2nd/3rd trimester ultrasound) requires a complete fetal anatomic survey. Use 76805 only if all required images and measurements are documented.

- CPT 76815 is used for limited ultrasounds performed to evaluate a specific issue, not for a complete anatomical survey. CPT 76816 is reported for follow-up ultrasounds to reassess fetal growth or monitor previously identified findings.

- Follow AIUM/ACR/ACOG practice guidelines for OB ultrasounds. For example, payers often allow only one full anatomy scan (76805) per pregnancy; additional scans usually must use 76815 or 76816 if justified.

How to Avoid It

- Use structured templates for ultrasound reporting that prompt all required elements (e.g., fetus in four quadrants, limb measurements, organ visualization) for a 76805 exam.

- Train sonographers and coders to pick the right code. Verify gestational age and clinical purpose. If a scan is only checking a known issue, use a limited code (76815/16) rather than 76805.

- Double-check post-scan that the documentation matches the code billed. If an element is missing, downgrade the code accordingly or annotate a future exam for completion.

Mistake 4: Misapplying the Global Maternity Package

Practices sometimes bill a component code when the global package applies, or use a global code when only part of the care was provided. For example, charging antepartum visit codes on one claim and then also billing the full global code for delivery causes underpayments or denials. This often occurs when multiple providers share care or when coders overlook what services are included in the global period.

What to Know

- Global codes (e.g., CPT 59400 for vaginal, 59510 for cesarean delivery) cover antepartum visits, delivery, and postpartum care as a package. They do not include services such as ultrasounds, amniocentesis, genetic testing, or unrelated problem visits.

- If your group handled only part of the care (e.g., only antepartum or only delivery), you must use the appropriate component code (e.g., 59409 for delivery only) rather than the global code. Payer rules vary, so always confirm each insurer’s definition of the “global” package.

- Bundled elements: Medicare’s NCCI policy clarifies that things like fetal monitoring, episiotomy, placenta delivery, and routine urinalysis are included in the global OB codes and cannot be billed separately. Billing these separately is incorrect.

How to Avoid It

- Maintain a concise cheat sheet of what’s included/excluded in the global package for each payer. List common add-ons, like ultrasounds and genetic tests, that must be billed separately.

- If the practice only provided part of the service, use the delivery-only or antepartum-only codes as appropriate.

- Clearly document any exception services to support separate billing. File those claims independently with the proper CPT and diagnoses.

Mistake 5: Pap Smear (Q0091/G0101) Mix-Ups

OB-GYN billing often trips up on cervical cancer screening codes. A common mistake is using the Medicare screening codes (HCPCS) incorrectly, or when a diagnostic test was performed. For instance, billing Q0091 (screening Pap) for a symptomatic patient, or failing to follow frequency and modifier rules, leads to denials.

What to Know

- For Medicare preventive visits, use HCPCS G0101 for the pelvic exam and Q0091 for the collection of a screening Pap smear. These codes are strictly for screening purposes.

- Screening frequency: Most Medicare patients qualify for a Pap screen every 24 months, while certain high-risk or younger patients may qualify annually. If a screening Pap is unsatisfactory and re-collected, bill Q0091 again with modifier -76 (repeat procedure by the same provider).

- Diagnostic Paps use standard cytology CPT codes (88141–88175, etc.), not the G0101/Q0091 screening codes. Misusing the codes or omitting required modifiers, like -76, will cause claim problems.

How to Avoid It

- Intake screening: Ensure office staff flag which visits are routine screening vs problem-focused. Only apply the G0101/Q0091 codes when the visit is truly a screening exam.

- EHR prompts: Program electronic health records or scheduling systems with Medicare screening intervals and reminders. For example, auto-alert when a patient becomes due for Pap screening and guide staff to use the correct codes, including the -76 modifier if a redo is needed.

Mistake 6: LARC (IUD/Implant) Coding Gaps

Billing intrauterine device (IUD) or implant services often go wrong when the device supply isn’t coded, or E/M visits aren’t tied correctly. Errors include charging CPT 58300/58301 without the HCPCS J-code for the device, or omitting an E/M with modifier -25 when a separate evaluation was performed.

What to Know

- Procedure Codes: IUD insertion is reported with CPT 58300; removal with 58301. Each requires billing the HCPCS J-code for the specific device (e.g., J7298/J7301 for levonorgestrel IUDs, J7300 for copper IUD).

- Supplies and Testing: Include charges for necessary supplies/tests. For example, a CPT 81025 for a pregnancy test, which is required before insertion. If ultrasound guidance is used, add 76998 (intraoperative ultrasound) and document medical necessity.

- E/M on the Same Day: If the patient had a comprehensive exam beyond the typical pre/post insertion evaluation, append an E/M code with modifier -25. Otherwise, omit separate E/M billing.

How to Avoid It

- Create “smart sets” or templates for IUD encounters that auto-include the CPT, matching J-code, and relevant diagnoses. This helps ensure no code is missed.

- Train staff to always add the device J-code whenever coding an insertion or removal. The procedure CPT and device HCPCS are billed together on one claim.

- Only add E/M +25 if justified by the documentation. For same-day removal and insertion, follow payer rules for multiple procedures, often requiring modifier 59/XU. Also, note the clinical reason for the replacement.

Mistake 7: Invalid Sterilization Consent (HHS-687)

Postpartum tubal ligations and interval sterilizations have strict consent requirements. A common mistake is attempting reimbursement without a properly executed HHS-687 consent form. CMS rules mandate that consent be signed at least 30 days and no more than 180 days before the procedure. Claims for tubal ligations without meeting these requirements are routinely denied and typically not appealable.

What to Know

- Consent Timing: The federal HHS-687 sterilization consent must be signed by the patient at least 30 days before surgery and no more than 180 days before. Exceptions, like premature delivery or an emergency surgery, allow a shorter window (≥72 hours).

- Documentation: Most states/MCOs require attaching a completed HHS-687 form to both the professional and facility claims. The form must have valid signatures and dates. Using an outdated version or missing fields will invalidate the claim.

- No Workaround: If the form is not correct or expired, the claim is denied and cannot be fixed after the fact.

How to Avoid It

- Integrate tracking of consent forms into the pre-op process. For example, alert staff to verify the HHS-687 during prenatal scheduling and note the signature date and expected delivery date in the chart.

- Educate schedulers and surgical teams to verify completion of the HHS-687 form at scheduling time. Ensure it is the current version and is attached to claims for surgeon, anesthesia, and facility when filing.

Mistake 8: CLIA/QW Compliance Errors for Office Tests

Many OB practices run point-of-care tests. Billing errors occur when a practice lacks a CLIA certificate for waived tests or omits the required modifier. For instance, Medicare requires modifier –QW on any CPT code for a waived test if it was performed under a waived CLIA certificate. Failing to include QW or not having a valid CLIA certificate will cause denials.

What to Know

- CLIA Certification: Any office performing lab tests, even waived tests like urine dipstick or pregnancy tests, must have an active CLIA certificate and number on file.

- Modifier QW: CMS publishes a list of all CLIA-waived tests requiring modifier QW on claims. For example, if you report CPT 81025 from a waived lab, you must append –QW. This signals the payer that the test was done in a CLIA-waived setting.

- Updates: The list of waived tests is updated periodically. It’s each provider’s responsibility to stay current with their MAC’s guidance.

How to Avoid It

- Enter your CLIA number into the billing system and audit it regularly. Ensure it populates automatically on all lab-related claim lines.

- Keep a quick reference of waived test codes and the requirement for the –QW modifier. If the practice starts a new waived test, immediately verify whether QW is needed.

- For example, before billing a pregnancy test, verify that the CLIA number and modifier QW are included on the claim.

Mistake 9: Timely Filing and Prior Authorization Lapses

Missing deadlines is a simple yet costly mistake. Claims outside the payer’s timely-filing window are denied outright. In Medicare, claims must be submitted within 12 months of service. Likewise, certain OB procedures often require prior authorization. Not obtaining or documenting the PA leads to denials or clawbacks.

What to Know

- Filing Deadlines: Medicare’s standard timely-filing period is 1 calendar year from the date of service. Commercial and Medicaid plans have their own time limits (often 90–180 days), so you must track each payer’s rules.

- Prior authorizations: Many OB procedures, like hysteroscopy, LEEP, sterilization and tests need pre-approval. CMS’s new rules are tightening PA processes for Medicare Advantage and Medicaid that increases payer scrutiny. Without a documented PA, claims are denied.

How to Avoid It

- Maintain a timely-filing calendar or alert system per payer. For example, set automated reminders at 30, 60, and 90 days post-service to submit any outstanding claims before deadlines.

- Build PA checks into scheduling. Before booking surgeries or procedures, verify if a PA is needed. If so, obtain the authorization number and record its expiration date in the patient’s chart. Attach or note the PA on the claim when billing.

- Stay informed about changing PA rules for CMS, Medicaid, and commercial plans, and update your billing processes accordingly.

Mistake 10: Diagnosis Coding Errors in Pregnancy

Using incorrect ICD-10-CM codes for obstetrics is a frequent error. A typical error is billing Z34.x (routine prenatal supervision) when the pregnancy is actually high-risk or has complications. In ICD-10, complication codes (Chapter 15, whichodes) take priority over Z34 if any complication is present. For example, coding Z34 for a patient with gestational diabetes is wrong and can lead to claim denials or audits.

What to Know

- Z34 codes should only be used when the pregnancy is truly uncomplicated. If any complicating condition exists, report the appropriate O-code with trimester specificity.

- ICD-10-CM requires specifying the trimester in O-code diagnoses. Chapter 15 (O00–O9A) complications are sequenced before Z34 when present.

- Always code to the highest level of specificity. For instance, use O10.00 (mild pre-existing hypertension, first trimester) instead of Z34.01 if hypertension is documented.

How to Avoid It

- Add screening questions during check-in about any new or chronic pregnancy-related conditions. If “yes,” code the specific O-code with the correct trimester.

- Use Z34 codes only for visits involving uncomplicated, normal pregnancy supervision. When any complication is present or suspected, report the appropriate, more specific O-code instead.

- Provide ongoing training to coders on ICD-10 obstetric coding rules to prevent miscoding.

Conclusion

Accurate OB-GYN billing is critical for compliance and financial health. As one expert summary notes, “Accurate billing in an OB/GYN practice is essential. It protects compliance and keeps the practice financially steady”.

By understanding and following the rules above, using the correct global vs. component codes, appropriate modifiers, and up-to-date forms, providers can dramatically reduce denials. Ongoing staff education, internal audits, and payer-specific reference guides are key to preventing errors.